You should be selling to diversify your book and help more people with their healthcare.

Many Medicare clients come to find out too late that Original Medicare, Medicare Advantage (MA), and Medicare Supplement (MediGap) plans don’t offer coverage for things like hospital stays, dental/vision/hearing coverage, common critical illnesses, and extended care. By offering ancillary plans you can help protect you Medicare beneficiary from incurring high out-of-pocket costs while adding value to your relationship and money to your business.

Any of these plans CAN be sold on a Medicare Advantage or Medicare Supplement appointment. There is no need to schedule a follow-up appointment to discuss any health-related ancillary products. Just be sure to have your client initial next to any of these products you plan to discuss on the Scope of Appointment (SOA) form. If your client brings up these products with- out initialing the SOA form, simply complete another SOA form before you discuss them further.

With individual cancer treatments costing upwards of $10,000, clients who get diagnosed are quickly going to hit their out-of-pocket maximum. If they are diagnosed toward the end of the year, it could cost them over $13,000 in a few months just for medical bills, never mind non-medical expenses. Even if they have a Medicare Supplement Plan, they could still have thousands of dollars in out-of-pocket cost. For about $30/month you could sell your client a $10,000 Lump-sum Cancer Plan (or about $45/month for a $15,000 plan) that pays upon first diagnosis and can be used to pay for anything your client needs.

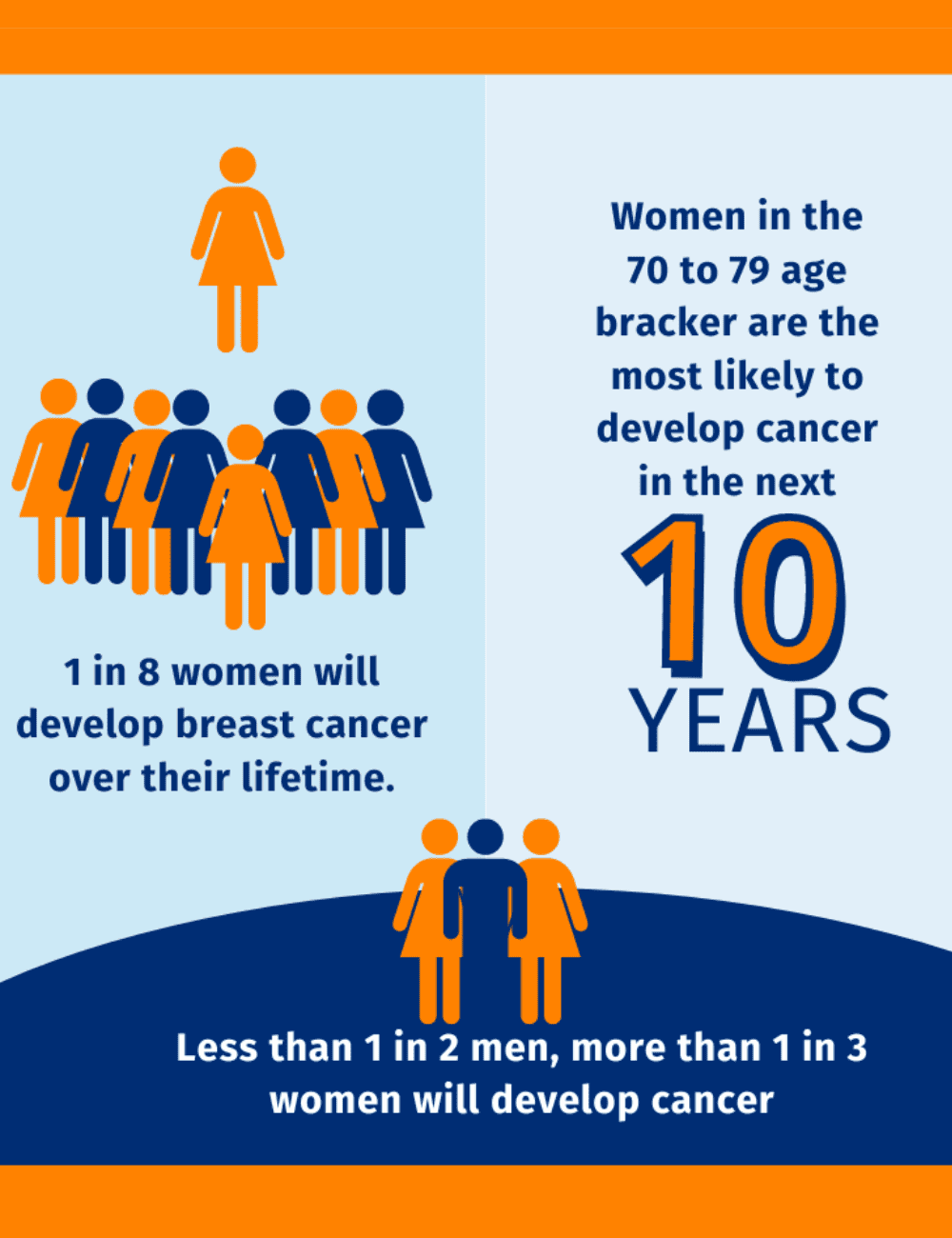

According to the American Cancer Society, one-third of all women and half of all men will develop cancer at some point in their lifetime. With that in mind, most people you encounter could benefit from Cancer insurance. These policies can be sold to Medicare beneficiaries as well as those in the under 65 market.

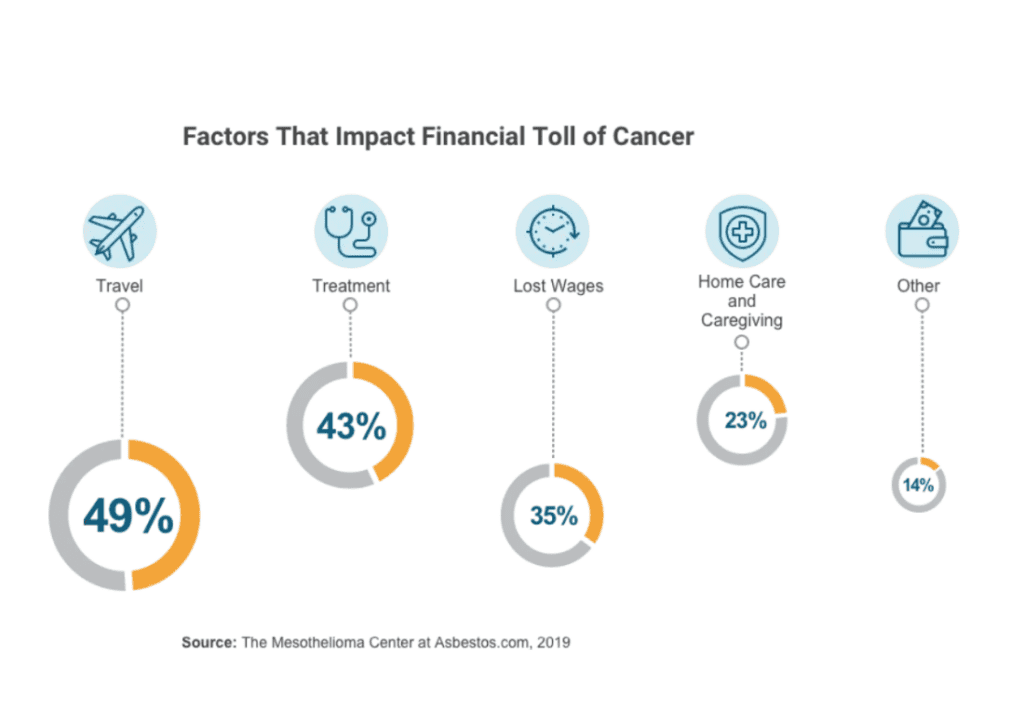

When you think about Cancer, non-medical costs are not considered. Major medical, Medicare, Medicare Advantage, and Medicare Supplements do not cover indirect costs related to cancer, such as travel, loss of income, childcare, experimental treatments, etc.

Below is a graphic that details some of the financial impacts that beneficiaries may incur. Cancer policies can help cover these costs.

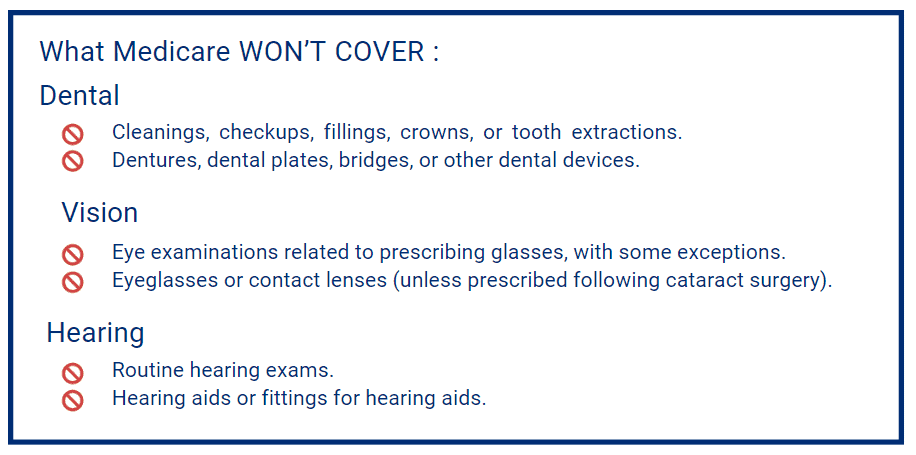

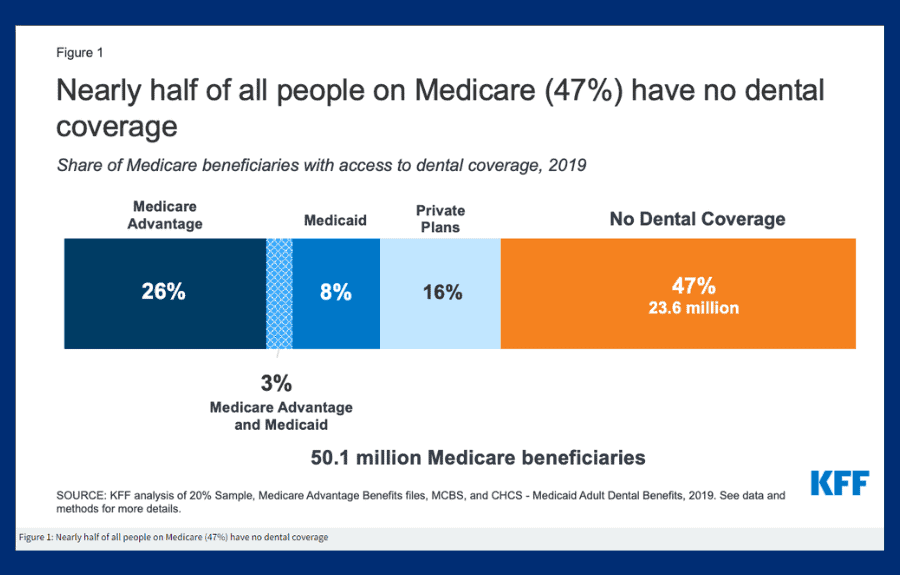

Dental, Vision, and Hearing (DVH) insurance is an insurance policy that provides coverage for preventative services, routine services, and emergent services. Many beneficiaries have coverage through an employer, whether it’s individual policy or a parent or spouse’s policy. Policies can be individual or combined as a DVH policy.

Original Medicare and Medicare Supplements do not cover basic DVH services which means that anyone would benefit from purchasing a plan. Medicare Advantage beneficiaries may have some coverage but typically it is not comprehensive.

Discuss with beneficiaries that good coverage is important because it can help maintain healthy dental hygiene as well as ocular health. Paying for a policy is more than likely cheaper than paying out of pocket for services.

Hospital Indemnity is a product that pays beneficiaries a pre-determined benefit amount directly to them when they are hospitalized. This allows the policy holder to not have network restrictions and use the funds as they see fit. They could use the funds to cover:

Medicare Advantage Plans vary, but they typically have a co-pay of $100 to 300 for days 1 through 6. Medicare Supplements may cover all hospital costs, but non-medical costs such as meals and transportation are not covered. A Hospital Indemnity Plan pays you cash to use as you see fit.

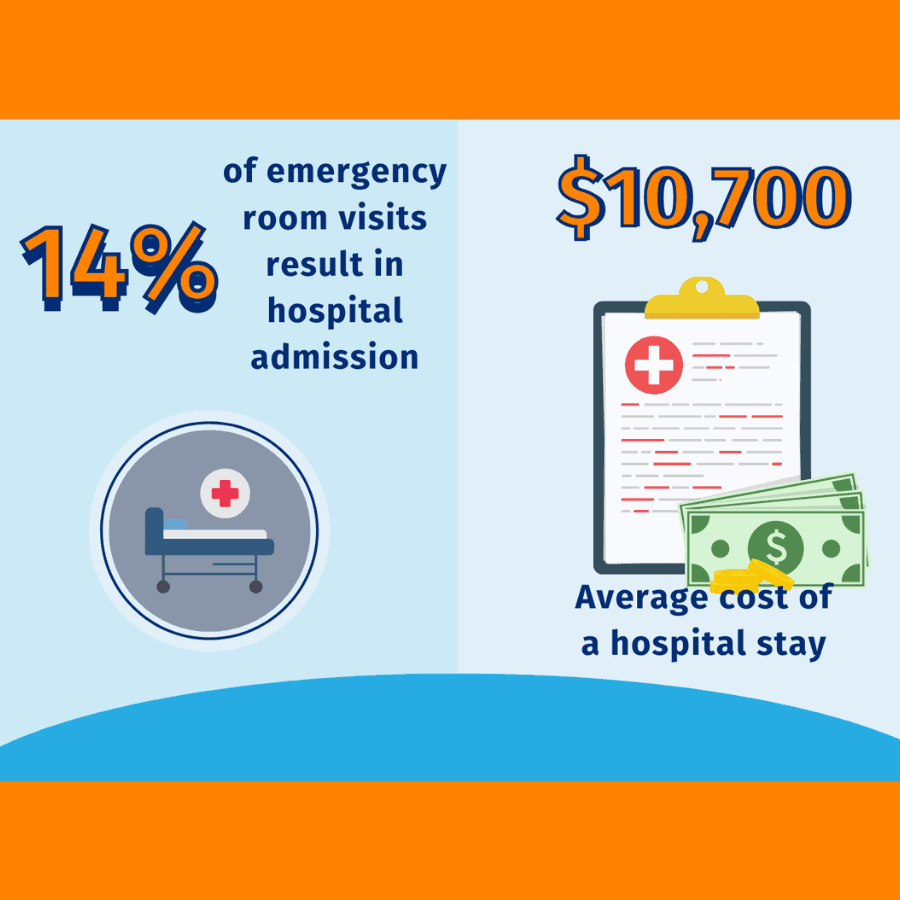

A client could be responsible for $2,000 or more following an inpatient hospital stay. The average emergency room visit is $1,233. Hospital stays are expensive with the average inpatient hospital stay in the U.S. costing $2,883 per day.

Many clients would be devastated if they had to pay those costs simultaneously. For $30 to $45/month, you could sell your client an easy-to-understand Hospital Indemnity Plan that will pay them a selected benefit amount over a certain number of days.

People of all ages can enroll in a hospital indemnity policy. This makes it a great fit for just about anyone. Specifically, think about your MA beneficiaries with $0-premiums. These policies typically have higher inpatient hospital copays. Also think of Medical Savings Plan owners. These plans have higher deductibles and if a hospital emergency happes, they’ll owe a lot of money.

Discuss with beneficiaries that good coverage is important because it can help maintain healthy dental hygiene as well as ocular health. Paying for a policy is more than likely cheaper than paying out of pocket for services.

Short-term Care usually covers one year of qualifying care or less for assisted living and home health care. Many policies have 0-day elimination periods, allowing beneficiaries to receive benefits on the day they qualify for the policy.

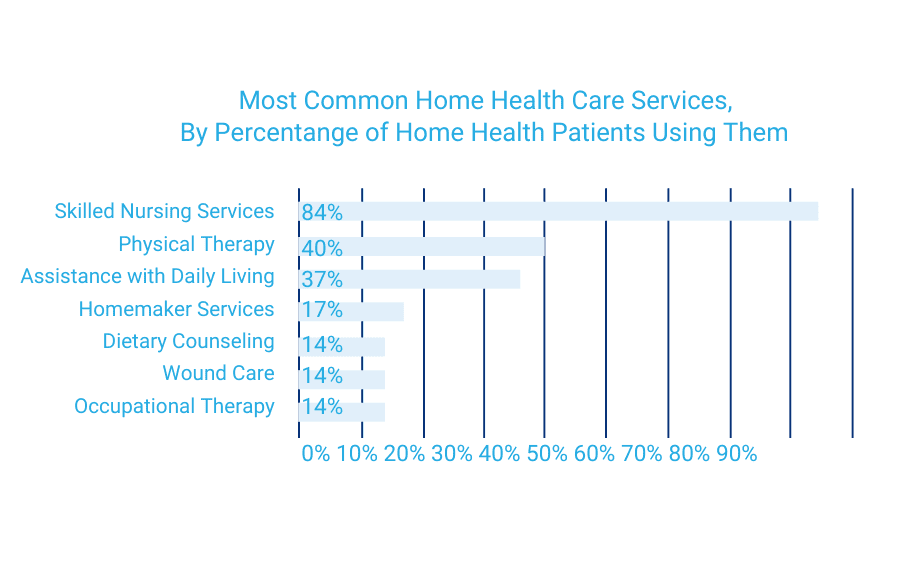

According to the Centers for Disease Control, 84% of home health patients require skilled nursing services. A skilled nurse or therapist typically costs $70.00 to $100.00 per hour.

While Medicare Supplements cover care in a skilled nursing facility, they don’t cover in-home skilled nursing. Medicare Advantage and Original Medicare only cover the first 20 days of home health care or nursing home stays.

An ideal client for short term health would be a person who is looking for a chaper altertnative to Long Term Care. Perhaps someone that is aged out of qualifying for LTC or have been turned down for LTC. One segment to look for would be beneficiaries looking to cover MA copays for nursing home stays and home health care costs.

Medicare only covers the first 20 days in a skilled nursing facility, with additional options under a short-term care plan to avoid a nursing home stay.

To qualify for Medicare recovery care, patients must meet specific requirements:

Due to the difficulty of meeting these requirements, a short-term care policy with a 0-day or 20-day waiting period ensures coverage. It’s beneficial for short-term care policies to start early, as clients would otherwise bear out-of-pocket expenses. Additionally, for clients with long-term care plans with an elimination period, a short-term care plan provides immediate coverage.

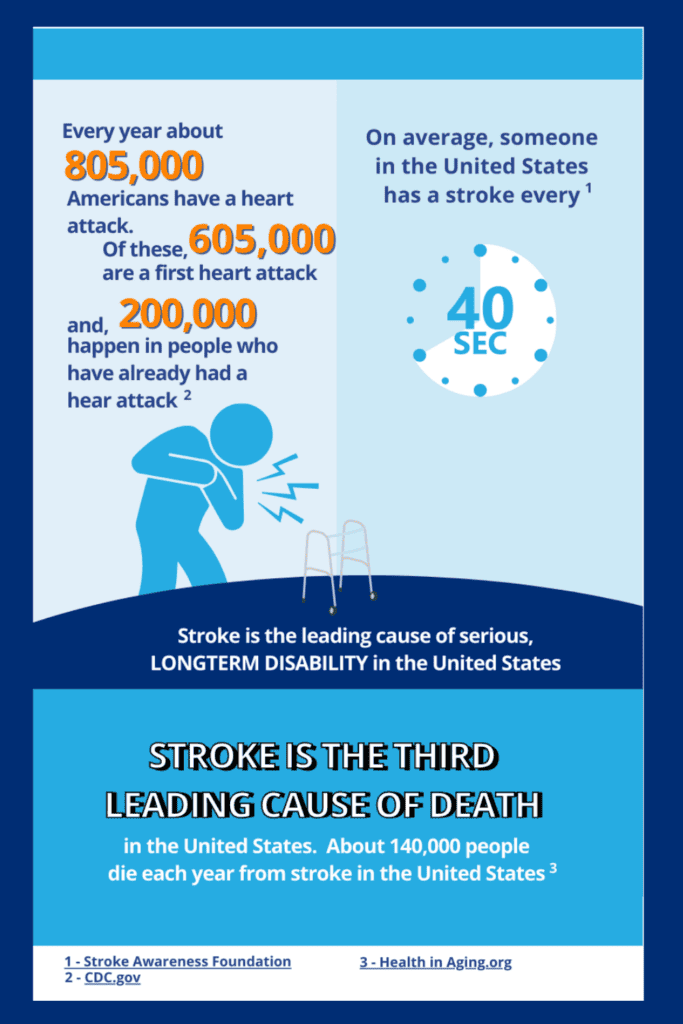

Serious illness can happen to anyone at any time. With that illness may come hardships, mainly financial strain. Loss of work, plus medical bills and other expenses, can add up. Critical illness insurance plans provide a lump-sum cash benefit to help cover expenses related to qualifying illnesses.

Critical illness policies pay the benefit directly to the policy holder. These plans can cover things like:

As with most of the ancillary products, most people could benefit from a critical illness policy. Medicare clients are a great target market. Anyone who has a family history of the conditions as well as anyone whose lifestyle increases risk for said conditions (i.e. smokers, obese individuals).

If you sell to under 65 population, you might target individuals with high risk jobs that disqualify them from disability coverage along with self-employed individuals.

The need for Critical Illness policies grow each year. Below are some stats:

Discuss with beneficiaries what CI policies can do for them and how they can help them in a time where funds may be scarce.

As part of our commitment to helping agents succeed at selling Medicare, ACA, and Life insurance products, we offer a growing library of in-depth guides. Click below for guides that help you maximize your insurance sales while serving your client’s best interests.

You got them, now keep them. Studies show it costs five times more to acquire a new customer than to retain one, and boosting retention by just 5% can increase profits by 25–95%.

Learn how to strengthen client relationships, grow renewals, and position yourself as a trusted resource with our latest guide.