You’re reading this guide because you want to make a sound, stable living for you and your family. To do that, you need to know how money works in this business. Most agents don’t have a great grasp on commissions, so you’ll be ahead of your competition from the start by reading this.

Medicare Advantage/PDP

- We’ll start with Medicare Advantage and PDP commissions. Don’t be confused: no, PDPs and Medicare Advantage plans aren’t sold together, but they are regulated the same way, including their commissions.

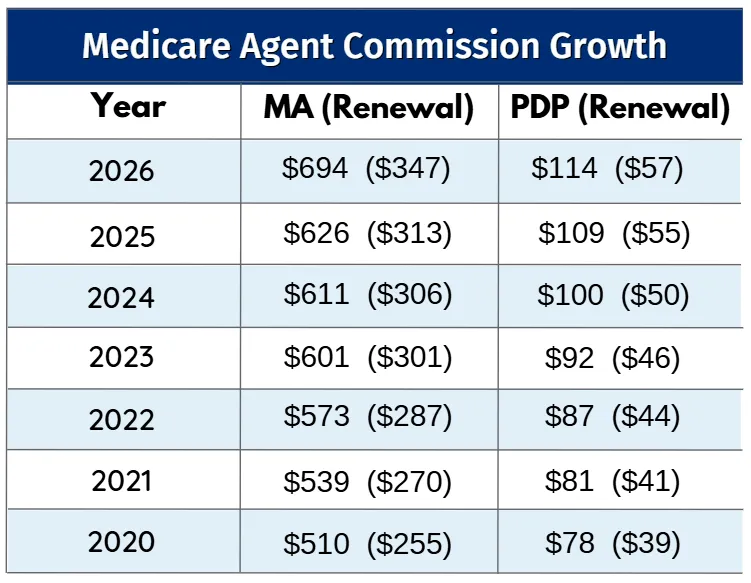

- CMS sets agent commissions for Medicare Advantage and PDP sales at Fair Market Value (FMV).

- FMV rates for Medicare Advantage have increased by over 40% in the last six years, and PDP rates have increased more than 55%. Now is the time to be in this business.

Understanding Rates: Intial vs. Renewal

The chart above shows two rates: Initial (also called New-to-Medicare) and Renewal/Replacement. The renewal commission is half of the initial.

Initial/New-to-Medicare

- You receive the entire Initial Rate when your client is enrolling in a Medicare Advantage plan for the first time.

- You should receive the commission within a few weeks of writing the application, no matter the time of year.

Renewal/Replacement Rate

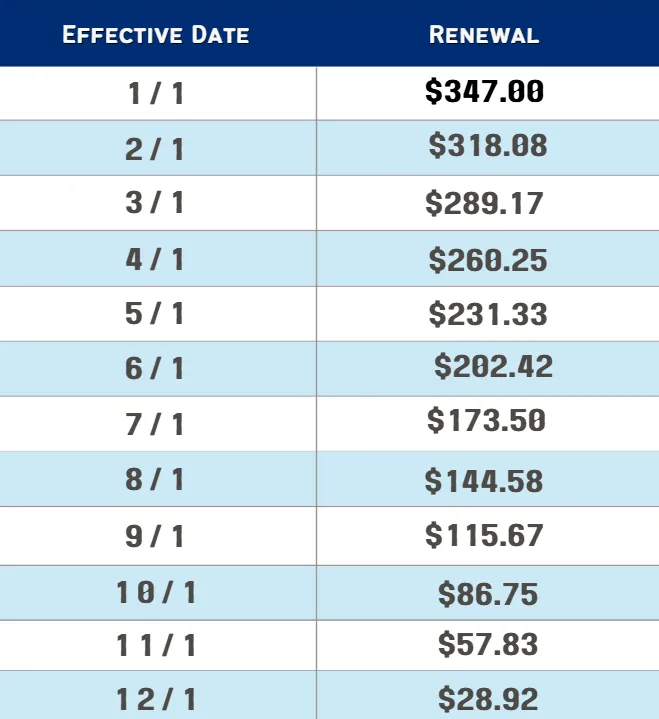

- You receive a prorated version of the Renewal Rate when you move a client from one Medicare Advantage plan to another.

- You will receive a proportionate amount based on the number of months that the client will be on their new plan through the rest of the year.

- All Medicare Advantage plans renew in January each year, and all 2nd-year renewal payments are made at the Renewal Rate.

- Most carriers make 2nd-year renewal payments in monthly installments.

Example 1

When Mrs. Smith enrolls in Part B, you help her enroll in an MA plan. If she has a 4/1/2025 effective date, you will receive $626 because Mrs. Smith is “new to Medicare.”

Example 2

Mrs. Smith has been on an MA plan for two years. She is eligible for an SEP, and you help her enroll in a new MA plan with an 8/1/2025 effective date. You will receive $144.58. Mrs. Smith will be on the new MA plan for five months during 2025, and she made a “like plan change” (5/12 x $347= $144.58).

In both examples, Mrs. Smith’s policy would renew on 1/1/2024 at the renewal rate.

Carriers can only pay commissions for a plan year during that plan year, so commissions for AEP business (effective January 1) are paid in January.

Renewal Rates for 2025

Getting started selling Medicare Advantage brings a couple of obvious financial difficulties, but the long-term payoff is well worth it.

- As you get further into the year, you will earn less per sale for a plan-to-plan change. There are three ways to make up for this: sell more, keep a steady stream of New-to-Medicare clients, or sell ancillary products.

- Selling more is the first solution as long as you can make the necessary investments. Constantly working your book of business and asking for referrals can help you find more clients turning 65.

- Ancillary sales pay the same commission levels year-round; they cover liabilities in Medicare Advantage coverage, helping boost client retention. Please refer to the Lead Generation section of this guide if you want more information on generating leads. We’ll talk about ancillary commissions in a minute.

Example

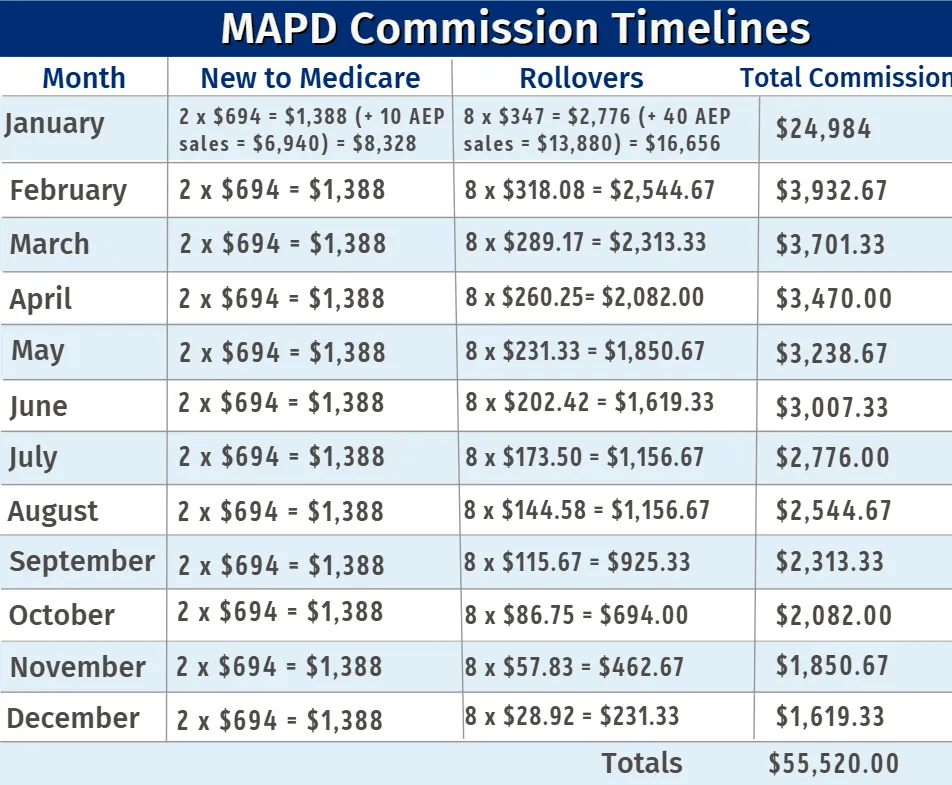

You write 10 Medicare Advantage apps per month and an additional 50 1/1 effectives during AEP. If we assume 20 percent are New-to-Medicare, here’s how the commissions look:

It’s important to remember that any 1/1 effective business will be paid in January, not when the application is written. In this scenario, you would earn around $30,000 your first year, with another $10,000 or so coming in January, for a total of $40,000 based on year one production.

Keep in mind that this business is a long-term play. If you did the same production in year 2, you would earn an additional $25,000 – 30,000 just in renewals because you would have over 100 policies renew in January. That’s an additional $2,000 per month coming in with little or no work required. In a few years, you could earn $100,000+ just in renewal income.

The first year is always the hardest. That’s why we will strongly push you to sell ancillary products to boost your commissions. Here is how ancillary commissions work.

CMS Final Rule 2025 Agent Compensation Changes Update

CMS’ 2025 Medicare Advantage & Part D Final Rule included sweeping changes to Medicare agent compensation. As a result, many in the industry expected to see standardized commissions and a cap on agent/broker non-salary compensation in 2025. However, on July 3, 2024, a federal judge in Texas granted a stay in Americans for Beneficiary Choice’s (ABC’s) and Council for Medicare Choice’s (CMC’s) lawsuits against the Department of Health and Human Services (HHS).

Right now, the effective date of CMS’ Medicare Final Rule 2025 commission changes is on hold while court proceedings decide if these changes exceed CMS’ statutory authority, are arbitrary and capricious, and were made following the proper procedures. The current ABC and CMC v. HHS lawsuits will determine if the CMS Medicare agent and broker compensation changes below can go into effect in the future.

- Eliminating separate administrative fees

- Setting clear, fixed amounts for MA and Part D sales, adjusted annually based on fair market value

- Capping agent and broker non-salary compensation

- Prohibiting enrollment incentives that may bias agent recommendations

These changes would require carriers to pay the same, set commissions, established by CMS, for MA and Part D sales. They may also affect and, potentially, eliminate health risk assessments (HRA) fees, marketing co-op, and enrollment-based bonuses offered by plans.

A final court outcome is not expected until sometime in 2025, or possibly even 2026.

The recent Medicare commissions court cases and changes can make it challenging to understand what’s happening with Medicare commissions. However, we can say that, as long as the court-ordered stay is in place, you can expect commission structure and opportunities to maintain the current status quo!

Ancillary Products

Ancillary products don’t renew on a calendar year basis but instead on a rolling 12-month basis from the policy effective date. That means the commissions aren’t prorated through the end of the year. You get paid the same no matter the time of year. Ancillary commissions are based on percentages of annualized premium (AP).

Example 1

Cigna Flex Choice Cancer – 60% Year 1 commission * average AP of around $500 = $300 Year 1 commission, 9-month advance = $225

Example 2

Medico Hospital Indemnity – 55% Year 1 commission * average AP of around $400 = $220 Year 1 commission, 9-month advance = $165

Most ancillary commissions are paid on a 9-month advance, with commissions paid monthly starting with the 10th month. So, in the Cigna example, you would get $225 when the policy issues and $25/month for the 10th, 11th, and 12th months. Most ancillaries drop to a much lower commission in years 2+ (roughly 5-12%). Still, that first-year commission can get you through times of the year when Medicare Advantage commissions are lower or when business is slower.

We generally see that one-third of clients will buy an ancillary plan if you present one. If you sell just one per week, it could mean another $15,000 in first-year commissions. We have agents who cover their car payments and more with only their ancillary commissions. Refer to the Ancillaries section and the Ancillaries portion of the Sales Techniques section for more information.

Don’t forget to offer appropriate ancillary products to clients on a Medicare Supplement, as well.

Medicare Supplements

Medicare Supplement commissions work the same way as Ancillaries, just with different percentages. Everything is based on a 12-month policy year, not a calendar year. Typical Medicare Supplement annualized premiums are around $1,500 depending on the client, and commission rates are generally 21-22% for at least the first six years.

Example 1

Mutual of Omaha Med Supp Plan G- 22% Years 1-6 commission * $1,500 AP = $330/year Years 1-6, 12-month advance.

Most Med Supp carriers will pay a 12-month advance, so you’ll get a full year’s commission no matter what time of year you write the application. Renewals are paid monthly starting on the 13th month, so $27.50/month in the example above.

Understanding Commissions is Vital

The first year is the toughest in this business, but you’re in a much better position to be successful when you understand how commissions work. Keep in mind how important Ancillary products are and how valuable client retention is to your renewal growth. If you do, you’ll be on track to build a profitable business and a secure financial future for you and your family.