Introduction

Why Retention?

Retention is the cornerstone of a thriving sales business. Many agents spend marketing dollars on finding new customers instead of fostering relationships with the ones they already have. It’s a constant struggle, but studies show it costs five times more to acquire a new customer than to retain an existing one, and increasing retention rates by just 5% can boost profits by 25-95%

This guide expands on the foundational principles of client retention. By following these steps, you’ll foster stronger relationships with clients, grow your renewals, and position yourself as a trusted resource.

Step 1

Offer your clients the right products

Your number one priority as a Medicare agent is making sure that your clients get the right coverage. Doing so means finding appropriate products, but it also means respecting clients’ budgetary and comfort needs.

Clients who feel their needs are met are more likely to stay loyal. By proactively offering solutions that align with their needs, you build trust and ensure their needs are well-covered.

That doesn’t necessarily mean recommending the cheapest plans. You’re looking for coverage that will meet your client’s long-term needs, which often means choosing plans with strong networks that will always be competitive. Discuss budgetary concerns with your clients to ensure that the plans you recommend don’t create an undue financial burden but prioritize their care.

Always Offer Ancillary Products

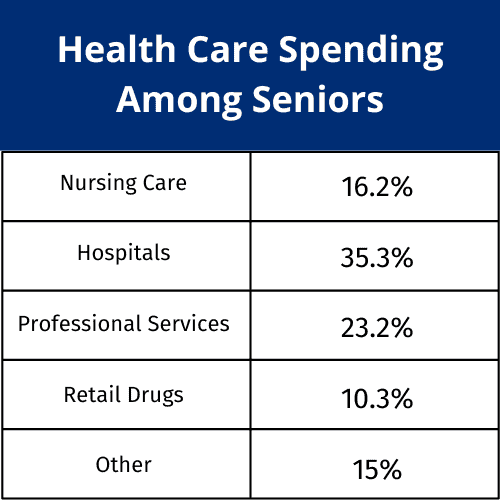

While it’s true that selling ancillary policies benefits the agent by helping to stabilize income, these products also fill a real need for clients. The chart to the side shows a breakdown of healthcare spending among seniors.

As you can see, hospital stays and nursing care make up significant portions of senior health care spending. Ancillary products like Hospital Indemnity and Home Health policies go a long way toward easing your clients’ financial burden when they need more advanced care.

You’ll receive some secondary benefits when you sell ancillaries, as well. The more products a client has through you, the more likely they are to stay loyal.

Additionally, effective positioning can lead to more referrals. Clients who have the ancillary policies they need when they need them will be grateful to you for helping them avert financial disaster, and they’ll show that gratitude by telling their friends.

Actionable Insights:

- Diversify Offerings: Go beyond Medicare Advantage or Supplement plans. Offer ancillary products like Dental, Vision, and Hearing (DVH) plans, hospital indemnity coverage, and cancer insurance. These products fill gaps in coverage, offering peace of mind.

- Look for Coverage Gaps Year-Round: Use every client interaction—whether during a routine check-in or when assisting with claims—to identify potential gaps in their coverage. Ask questions like, “Are you happy with your current dental coverage?” or “Would you like to explore options that reduce your out-of-pocket costs for hospitalization?”

Real World Example:

John, a Medicare agent, noticed that many of his clients had high hospital copays under their Medicare Advantage plans. He began offering hospital indemnity plans during client reviews. As a result, his retention rates climbed by 15% because clients valued the additional protection.

Step 2

Keep Comprehensive, Up-to-date records

You want your clients to be confident in their coverage and your representation of them, and you want to earn that confidence. Good record-keeping is a vital part of your client retention strategy because it allows you to communicate with clients on a personal level and respond to changes in their coverage more quickly.

Accurate records not only help you serve clients better but also demonstrate professionalism. Clients appreciate when you remember details about their coverage or health concerns.

How to track information

Agents just starting out or with smaller client bases may find that a spreadsheet does the job, but we strongly recommend using a customer relationship management tool (CRM) to track your client information.

CRMs can seem like a significant investment, but the return you get in terms of efficiency makes the cost more than worthwhile. A spreadsheet will track details. A CRM will track those details and help you use them to automate processes and communication.

The list of available CRMs is vast, and the cost varies widely, but you can usually find a starter plan for less than $50 a month. At that price point, if your CRM helps you retain just three clients, it has paid for itself.

What to Record

If you do choose to try tracking on your own with a spreadsheet, start with the basics:

- The client’s essential information like name, address, and date-of-birth.

- The date the client initially enrolled.

- All plans in which the client is enrolled.

- Any yearly changes or updates to the client’s coverage.

It’s also useful to track personal details about your clients. Keep up with things like:

- Family Members Is the client married? What are the names of their spouse, children, or grandchildren? Any recent milestones?

- Work and Work History Does the client work? If they are retired, from what industry?

- Hobbies and Interests Does the client have hobbies? Watch sports? Volunteer?

Actionable Insights:

- Organize Client Data: Use a CRM (Customer Relationship Management) system to track policy details, renewal dates, and personal notes. For example, document their spouse’s name or their preferred communication method.

- Track Key Milestones: Set reminders for birthdays, anniversaries of joining Medicare, or upcoming policy renewals to personalize your interactions.

Real-World Example:

Samantha, a Medicare agent, used her CRM to send personalized birthday emails to her clients. One client, Mary, was so impressed that she referred two of her friends to Samantha, saying, “She truly cares.”

Step 3

Keep Open Communication with clients

Client communication is essential in every industry, but even more so when you’re dealing with Medicare beneficiaries who count on you to make sure they’re getting the health care coverage they need.

Reach out twice a year Minimum

You should be checking in with your clients at least twice a year. Any effort you put in beyond that will be rewarded with increased loyalty. In fact, Humana recommends a much broader approach, especially in your client’s first year. They call it “3-30-60-90.” They’ve written an excellent guide that you can find here. We highly recommend reading it and trying out this approach.

Outside of regular check-ins, refer to your records so that you can send birthday cards, call and check on your client’s new grandchild, or ask them how they feel about their favorite sports team’s prospects this season. Connect with them on a personal level, and follow that up by verifying that they’re still happy with their coverage and don’t have any questions or concerns. Consistent communication ensures clients feel valued and supported. Proactive outreach can reduce the risk of clients switching to another agent.

Always Check in Near AEP

Even if you stick with the minimum two contacts per year (and we strongly recommend you go beyond that), make sure that one of those contacts happens near AEP. Not only do you need to review each client’s coverage annually, but you also need to get ahead of other agents. They, like you, will be working overtime to grow their book of business.

Actionable Insights:

- Educate Clients: Send newsletters or emails about industry updates, such as Medicare changes or new product offerings. Simplify complex topics so clients understand their options.

- Check In Regularly: Schedule quarterly calls or emails to touch base. Ask questions like, “How is your current coverage working for you?”

Real-World Example:

Tom, a Medicare agent, began sending quarterly newsletters highlighting Medicare tips and reminders about AEP. Clients started calling him with questions rather than seeking information elsewhere, boosting his retention rates by 20%.

Pro Tip:

Be responsive. A study by Harvard Business Review found that businesses responding to inquiries within an hour were 7x more likely to convert leads. The same principle applies to maintaining client relationships.

Explore Our Guides

As part of our commitment to helping agents succeed at selling Medicare and senior insurance products, we offer a growing library of in-depth guides. Created by the experienced agents on the NCC team, these guides are no-fluff handbooks filled with useful information and actionable advice. Find guides and downloads to help you navigate enrollment periods, sell specific senior insurance products, and maximize your Medicare sales while serving your clients.