The Affordable Care Act (ACA), also known as “Obamacare” or officially as the “Patient Protection and Affordable Care Act,” was signed into law in 2010. This federal legislation reshaped the healthcare and insurance system in the United States, aiming to provide affordable health coverage to millions of Americans. The ACA introduced several critical reforms that have increased access to health insurance and expanded consumer protections.

* The mandate was repealed in 2019. However, as of 2022, some states have established their own mandates and penalties (California, Massachusetts, New Jersey, Rhode Island, and the District of Columbia), while Vermont has an individual mandate without a penalty.

Additionally, the ACA includes lesser-known benefits such as access to breastfeeding equipment and support, birth control, counseling, and coverage for substance abuse treatment—a crucial provision amidst the opioid crisis. The ACA also empowers policyholders by granting them the right to appeal an insurance company’s decision to deny a claim or terminate coverage. It further protects employees from retaliation by employers if they receive premium tax credits or report ACA violations. Selling ACA plans offers insurance agents a significant opportunity to expand their business to meet the growing need for affordable health coverage in the United States. ACA Plans make a valuable addition to an agent’s portfolio by allowing them to serve a multitiude of customers and foster lasting relationships.

More clients are seeking affordable health care options. ACA marketplace plans are increasingly popular, particularly for those who qualify for subsidies that can make their coverage more accessible. In 2023 alone, 3.6 million people enrolled in ACA plans for the first time, contributing to a record-breaking total of 16.3 million enrollees during the Open Enrollment Period (OEP).

Certain demographics, such as Black, Latino, and some Asian populations, have historically been underinsured or uninsured. According to healthcare.gov 1.3 million Hispanic/Latino individuals and 686,875 Black individuals enrolled in ACA plans in 2022. This reflects a significant opportunity for you as an agent to reach underserved markets and to provide important access to affordable healthcare.

ACA plans have become more affordable than in prior years, making them an attractive choice for a wide range of consumers. In 2023, four out of five marketplace enrollees were able to find a plan for $10 or less per month. As living expenses continue to rise, particularly post-pandemic, the appeal of affordable ACA plans is stronger than ever.

For you the agent, this represents a lucrative opportunity to grow your business by meeting a critical need. By offering ACA plans, you can help clients navigate the marketplace, and secure affordable coverage, fostering trust and long-term client loyalty.

To sell ACA plans you have to have only one certification annually, the Federally Facilitated Marketplace Certification. This is a FREE certification that consists of 10 modules and four exams. You must pass each exam with a score of 70% or higher. Returning agents can also renew their certification with a condensed version of the training.

If this all sounds confusing, don’t worry. We have a dedicated ACA Sales Support Specialist to help you. Reach out and she can walk you through the process.

ACA Plans are not as regulated as other insurance products you may have in your portfolio, like Medicare Advantage or Part D Prescription Drug Plans. There are no set rules for selling ACA plans.

When selling ACA plans, you as an agent are required to gain a customer’s authorization. Per CMS, agents must:

Qualification for ACA plans is simple. There are 3 main criteria to ask:

Medicare beneficiaries would not be eligible for ACA health coverage and, therefore, cannot purchase coverage through the marketplace.

The marketplace is known by many names. Exchange, Marketplace, and FFM just to name a few. This is where people go to buy under-65 health plans.

Plans can be sold both ON market and OFF market. ON Market is done through the exchange and these plans qualify for premium assistance and cost sharing reduction. OFF Market plans are direct to the carrier and do not qualify for any assistance.

The federal marketplace is accessed through HealthCare.gov. The federal marketplace is not available in all states. These states have their own marketplace sites or exchanges.

The current enrollment window for ACA is the Open Enrollment Period (OEP) from November 1 through January 15 of each year. For plans sold from November 1 to December 15, coverage typically starts on January 1. Plans sold between December 16 and January 15 usually take effect on February 1. However, state exchanges may have different rules, with some extending the OEP to allow enrollments until January 31, leading to a March 1 start date.

No changes may occur to a client’s ACA coverage outside of the OEP unless they qualify for a Special Enrollment Period (SEP). If a client changes employers, they could switch to the new employer-sponsored health plan but may no longer qualify for tax credits or other savings they had through the ACA plan.

To take advantage of an SEP, clients must act within 60 days of the qualifying event.

Preparing to sell ACA plans does not have to be overwhelming. This section will discuss some tips on marketing of ACA to get you started.

You don’t have to go far to find potential clients for your ACA business. Think about your personal network. Reach out to friends, family and current clients who are under 65.

Do you know any small business owners or self-employed people that could benefit from your help in providing health care.

The biggest location for under-65 clients is the internet! Consider using online tools to help market your services. Create social media pages for your business and use those to share content with your audience. NCC provides a couple of tools to help you get started. Check out the Online Presence Guide and the Facebook Toolkit.

Both these tools will help you develop an online presence that you can use to help promote any insurance business you would like. You can also reach out to NCC’s marketing department and discuss ways to improve your online presence.

You might not believe it, but this is a tried and true method of making sales. The ACA market is not as regulated as the over-65 health industry and cold calls to prospects is allowed.

You do have to abide by your states tele sales rules and scrub any list against the Do Not Call list. There are fines for violating that rule! For more information on DNC you can check out the Federal Trade Commission website.

Getting involved locally, sometimes called “Grassroots Marketing”, helps to get your name out into your community. It helps build your brand. Connect with small business owners in your community. You can be a great resource to those that are looking to potentially purchase from the marketplace but are unsure. Attend local business expos or workshops. Offer to share presentations about ACA for their audiences.

It may not lead to clients right away, but it will help build your brand and develop a trustworthy image for you in your community. People will feel comfortable reaching out for help to someone that they know.

Referrals are by far the most cost effective lead source available to insurance agents. By providing great service to your clients, they will in turn share about you with their friends, family, and coworkers. Make sure to ask on every appointment for them to share your name with anyone who may need help with ACA.

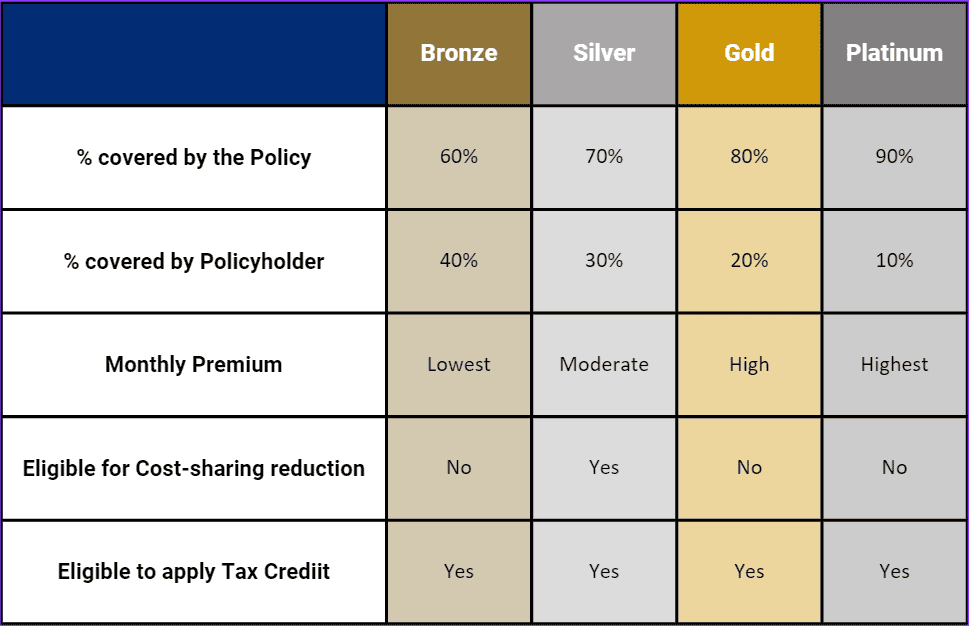

Plans are separated into four metal categories: bronze, silver, gold, and platinum. The table above is the basic structure of the metal tiers.

As the tiers go up, the member’s coinsurance responsibility goes down, however their monthly premium increases. The Silver plan is the most popular plan in the marketplace as it is the only plan that offers cost-sharing reductions and subsidies if a client qualifies.

There is an additional play option available for unique scenarios. The Catastrophic plan is offered to clients under 30 or over 30 with a “hardship” or “affordability” exemption. These plans are not as relevant since the individual mandate was repealed.

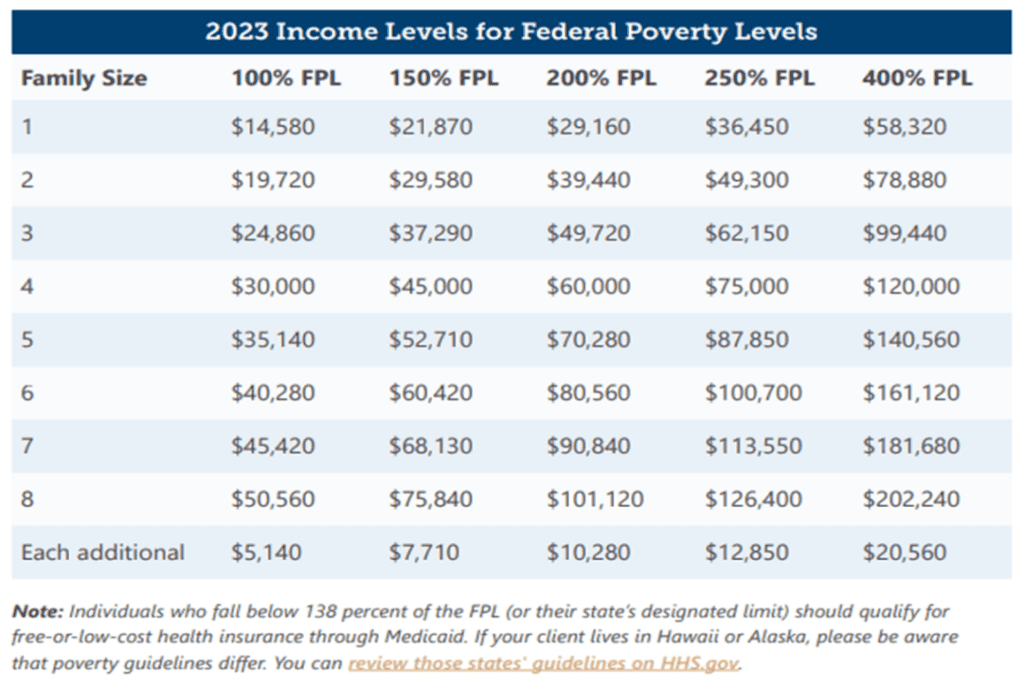

As you assist your clients, keep in mind that they may qualify for an ACA subsidy. Officially called Advanced Premium Tax Credit, it is designed to help income challenged individuals and families afford coverage.

The Inflation Reduction Act of 2022 (IRA) extended the subsidies through 2025. This means that more clients will be able to take advantage of the savings.

To qualify for a subsidy, a client must meet the following criteria

‘* to be considered affordable, the health plan must provide at least 60 percent of covered benefits or have premiums that would cost the member no more than 8.5 percent of their household income annually after tax credits

danielle.byers@nccagent.com

865-350-6523

As part of our commitment to helping agents succeed, we offer a growing library of in-depth guides. Click below for guides that help you maximize your sales while serving your client’s best interests.

You got them, now keep them. Studies show it costs five times more to acquire a new customer than to retain one, and boosting retention by just 5% can increase profits by 25–95%.

Learn how to strengthen client relationships, grow renewals, and position yourself as a trusted resource with our latest guide.