Medicare is a federally funded health insurance program that covers:

Medicare is funded by a branch of the Department of Health and Human Services (HHS) called The Centers for Medicare & Medicaid Services (CMS). CMS also monitors Medicaid programs offered by each state.

There are two fundamental parts of Original Medicare: Parts A and Part B

Helps cover:

Helps cover:

Most people assume that Medicare is free, but in fact, it is not. Beneficiaries are generally responsible for premiums, deductibles, copays, and coinsurances. Some of these costs, however, may be covered by programs like Extra Help and Subsidies. We’ll cover those programs in detail in Chapter 3 of this guide.

Premiums for 2026

Most Medicare beneficiaries don’t pay a monthly premium for Part A (sometimes called “premium-free Part A”) as long as the beneficiary or their spouse worked and paid Medicare taxes for at least 40 quarters. If the beneficiary or spouse paid Medicare taxes for fewer than 30 quarters, the standard Part A premium is $565. If the beneficiary or spouse paid Medicare taxes for 30-39 quarters, the standard Part A premium is $311.

With Part A Hospital Inpatient Deductible and Coinsurance, the Beneficiary Pays:

Premiums for 2026

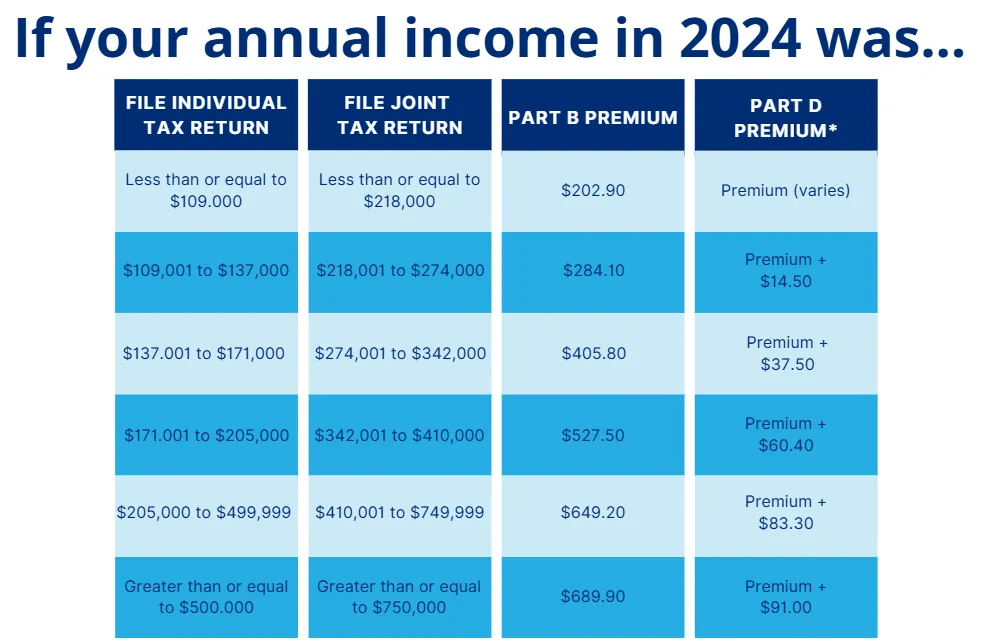

Medicare beneficiaries must pay a premium each month for Part B. For 2024, the standard Part B premium amount is $202.90, and this is what most beneficiaries will pay. Their Part B premium will be automatically deducted from their benefit payment if they receive benefits from:

If they don’t receive these benefit payments, they’ll be billed for the premium.

However, if the beneficiary’s modified adjusted income – as reported by their IRS tax return from 2 years before – is above a certain amount, they will pay an Income Related Monthly Adjustment Amount (IRMAA) in addition to their premium.

Tax returns may be classified as inaccurate or out of date for the following reasons:

A beneficiary may qualify for a new Part B determination after experiencing one of seven life- changing events that affect their modified adjusted gross income. Events that meet these criteria are:

Deductible & Coinsurance

In 2026, Medicare beneficiaries pay $283 for their Part B deductible. After they meet their yearly deductible, they typically pay 20% of the Medicare-approved amount for the following services:

How to Apply for Medicare

Some beneficiaries receive Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) automatically, while others have to sign up for it. In most cases, it depends on whether or not they’re receiving Social Security benefits.

When applying, the beneficiary selects one of the following situations that applies to them:

Doing so via this website would direct them to the appropriate enrollment platform.

Some beneficiaries choose to delay Part B when they initially become eligible for Medicare, often so that they may keep the group health coverage provided through their employment. To delay Part B, the beneficiary would indicate such to the Social Security Administration upon notice of becoming eligible for Medicare.

Conversely, a beneficiary desiring to enroll in Part B after initially delaying it would do so by applying for Part B via the Social Security Administration office or website.

It should be noted that a client delaying Part B without having creditable coverage would be restricted in reacquiring it. They would be required to enroll during the Part B general enrollment period (January 1 – March 31 with coverage starting the first of the month after you sign up) and would be penalized for time-lapsed in which they were eligible for Medicare and not covered by creditable coverage. The penalty would be assessed monthly for the rest of their life.

However, loss of creditable group coverage triggers a Part B special enrollment period, and the beneficiary would not be subject to a penalty in that scenario.

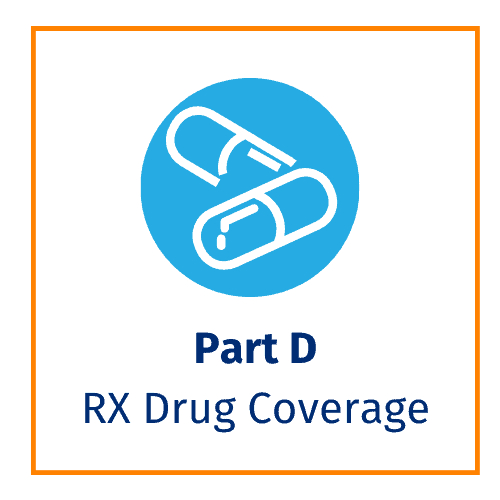

How Are Prescriptions Covered?

In order for a Medicare beneficiary’s prescriptions to be covered, the beneficiary must have Part D coverage through either a standalone Prescription Drug Plan (PDP) or a Medicare Advantage plan that includes drug coverage.

Helps Cover:

A Medicare beneficiary having only Part A or Part B may still acquire drug coverage through a standalone Prescription Drug Plan (PDP).

The late enrollment penalty is an amount added to the Medicare beneficiary’s Part D monthly premium. They may owe a late enrollment penalty if, for any continuous period of 63 days or more after their Initial Enrollment Period is over, they go without one of these:

The cost of the late enrollment penalty depends on how long the beneficiary went without Part D or creditable prescription drug coverage and will be added to your monthly premium. They will pay an extra 1% for each month (12% per year) you could have signed up for Part D, but didn’t.

Most Medicare drug plans have their own list of covered medications, called a formulary. Plans cover both generic and brand-name prescription drugs. The formulary includes at least two drugs in each therapeutic category. This ensures that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least two drugs per drug category, but plans can choose which specific drugs they cover.

To lower costs, many plans place drugs into different “tiers” on their formularies. Each plan can divide its tiers in different ways. Each tier costs a different amount. Generally, a drug in a lower tier will cost the beneficiary less than a drug in a higher tier. See the example below:

This tier consists of commonly prescribed generic drugs. Beneficiaries pay the least for drugs in this tier.

Drugs in this tier are generic and slightly more costly than those in Tier 1.

This tier consists of brand-name prescription drugs without a generic equivalent. They’re lower-cost than conventional branded drugs.

Drugs in this tier are brand-name and do not have a generic equivalent. They’re typically more expensive than those in Tier 3.

This tier consists of high-cost specialty drugs that treat complex conditions like cancer. They may be generic or brand-name. Beneficiaries typically pay the most for drugs in this tier.

In some cases, if the beneficiary’s drug is in a higher (more expensive) tier and their prescriber thinks they need that drug instead of a similar drug on a lower tier, they can file an exception and ask their plan for a lower-tier placement/copayment.

The Inflation Reduction Act of 2022 has several provisions to lower prescription drug costs for Medicare Beneficiaries and reduce the drug spending by the federal government. These changes include a cap on out-of-pocket drug spending for enrollees and requiring Part D plans to carry a greater share of the cost.

In 2025, Part D enrollees’ out-of-pocket costs will be capped at $2,000. This amount will be subject to rise each year after 2025 at the rate of the growth per capita in Part D costs.

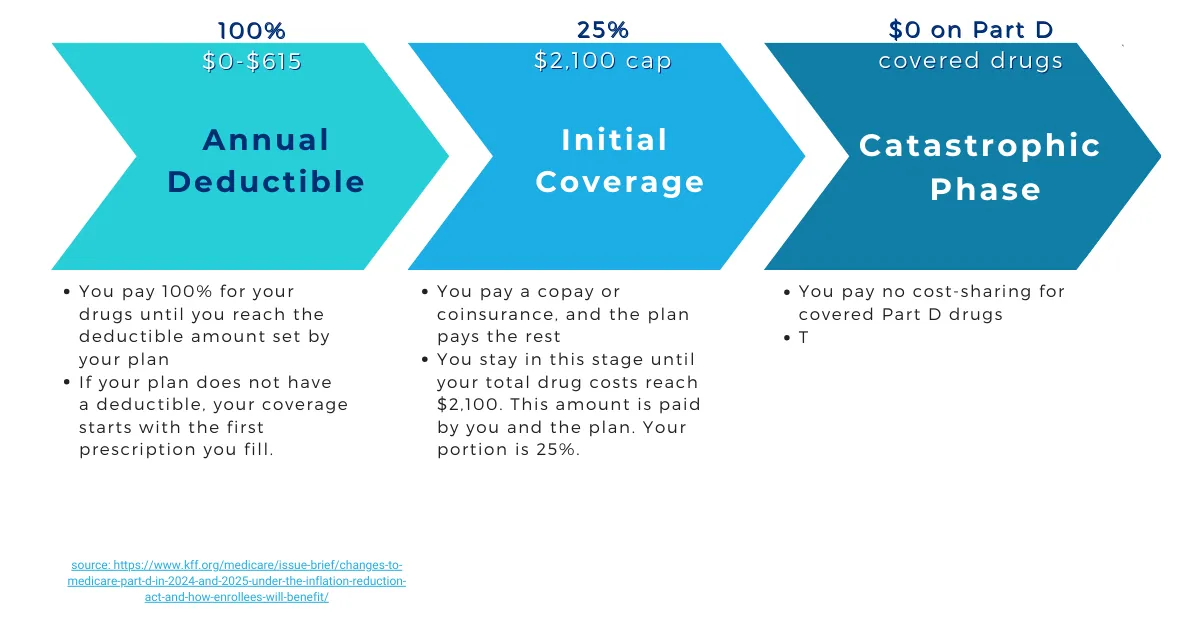

The coverage gap phase, or Donut Hole, will be eliminated in 2025. Part D will now have three phases: the Deductible Phase, the Initial Coverage Phase, and the Catastrophic Phase. With these new phases, a beneficiary will only spend money on two of them.

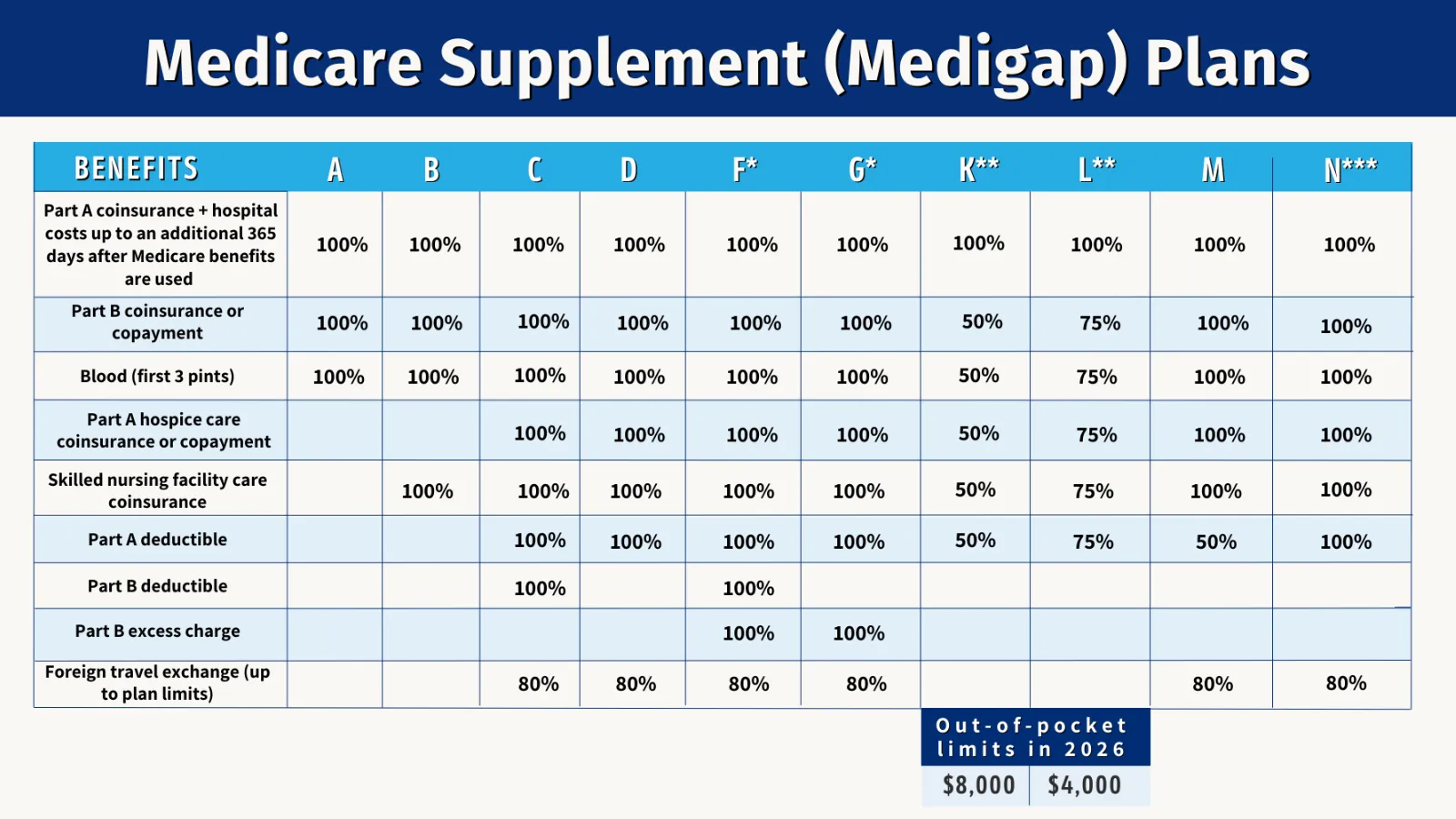

Medicare Supplement (often called Medigap) helps fill “gaps” in Original Medicare and is sold by private companies. Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like:

Medicare Supplements impose no hospital/medical network restrictions and do not replace Medicare. They pay – according to the plan contract – the cost that remains after Original Medicare has paid. If you have Original Medicare and you buy a Medigap policy, here’s what happens:

Medigap policies generally don’t cover long-term care, vision or dental care, hearing aids, eyeglasses, or private-duty nursing. Some Medigap policies do cover services that Original Medicare doesn’t cover, like medical care when you travel outside the US.

Note: Plan C & F aren’t available if you turned 65 on or after 1/1/2020, and to some people under age 65. You might be able to get these plans if you were eligible for Medicare before 1/1/2020, but not yet enrolled

*Plans F and G also offer a high-deductible plan in some states. You must pay for Medicare-covered costs(coinsurance,

copayments, and deductibles) up to the deductible amount of $2,950 in 2026 before the policy pays anything.

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible ($283 in 2026), the

Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a

$50 copayment for emergency room visits that don’t result in inpatient admission.

Medicare Supplement policy premiums vary depending on age, gender, and – when underwritten – tobacco use and the health of the insured. No underwriting stipulations are in effect during the Medigap Open Enrollment period; otherwise, underwriting is mandated. For more information, see the “Enrollment Periods” section.

Source: Medicare.gov

Medicare Part C is commonly called Medicare Advantage (MA). Medicare Advantage Plans are a type of Medicare health plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits. Most MA plans also offer prescription drug coverage.

Helps cover:

If a Medicare beneficiary is enrolled in a MA Plan, most Medicare services are covered through the plan. While the premium is typically less than a Medicare Supplement (in many cases, as little as $0), MA enrollees will incur copays and coinsurances that would be paid by a Medicare Supplement. However, an MA plan’s Maximum Out of Pocket limits the amount of copays/coinsurances the beneficiary would potentially pay per year.

Another way that Medicare Supplement differs from Medicare Advantage is Hospital/Medical networks. MA’s have network restrictions; Med Sup’s do not. Below are the most common types of MA Plans:

Eligibility

In order to be eligible for a Medicare Supplement/Medigap or Medicare Advantage/Part C coverage, the insured must be a beneficiary of both Medicare Parts A and B. Again, a beneficiary having only Part A or B may enroll into a standalone Prescription Drug/Part D Plan.

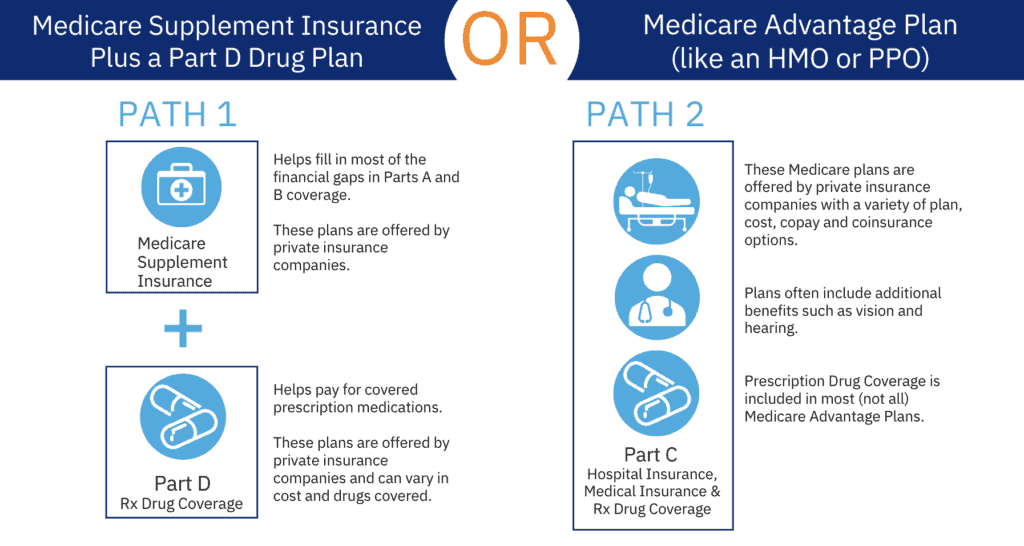

No. Medicare beneficiaries should choose one “Path” or the other.

MSA Plans

Some private insurance companies offer a consumer-directed Medicare Advantage Plan, called a Medicare MSA Plan. These plans are similar to Health Savings Account Plans available outside of Medicare. Beneficiaries can go to any Medicare-participating provider and use the money in their account to pay for any covered services. An MSA Plan must cover all of the same services any MA plan is required to cover.

Medicare MSA Plans combine a high-deductible insurance plan with a medical savings account that beneficiaries can use to pay for their health care costs.

1. High-deductible health plan: The first part is a special type of high-deductible Medicare Advantage Plan (Part C). The plan will only begin to cover the beneficiary’s costs once they meet a high yearly deductible, which varies by plan.

2. Medical Savings Account (MSA): The second part is a special type of savings account. The Medicare MSA Plan deposits money into the beneficiary’s account. They can use money from this savings account to pay for health care costs before they meet the deductible. Once a beneficiary meets their deductible, the plan will pay 100% for covered services.

Note: MSA plans do not cover Part D benefits. Beneficiaries in an MSA must get a standalone PDP for drug benefits.

Which Path is Better?

Better coverage depends on the needs/resources of the client. Both Medicare Supplement and Medicare Advantage have a vital role to play in the lives of Medicare beneficiaries. Determining which path is best takes place during the consultation/positioning process with you, the agent.

That’s where you come in! In the Sales Techniques portion of this guide, you’ll learn how to position, present, and sell these coverages properly.

You got them, now keep them. Studies show it costs five times more to acquire a new customer than to retain one, and boosting retention by just 5% can increase profits by 25–95%.

Learn how to strengthen client relationships, grow renewals, and position yourself as a trusted resource with our latest guide.