In this section, we’ll outline a tested and proven process of successful sales techniques. As you study these principles, you’ll notice that they have an order and flow that naturally leads to a sales opportunity. When followed, you will see how making sales based on understanding rather than coercion is most appropriate, especially when covering health and life risks. Your objective as the agent should be to use your product knowledge to meet the client’s specific needs, thus leaving them more comprehensively covered than before you met with them.

Self-Introduction/Purpose of Meeting/Call

Whether on the phone or face-to-face with your client, your introduction should be prompt, precise, warm, and friendly. Here’s an example: “Hello , my name is and we have an appointment to discuss your medical benefits.” This step will set the tone for the entirety of the business relationship you share with your client. Don’t skip it!!

Getting to Know the Client - "Warm-up"

This is the portion of the consultation that cannot be substituted with anything else. Here you will get to know your client. If you pay attention during this phase, the client will inform you of what’s most important to them, their concerns, and their preferences. Ask questions of interest and follow up based on their response. Be personable, open, and attentive. Know how to talk about something other than insurance. Take as long to warm up as your client prefers. You will not regret knowing your client well when it comes time to ask for the sale.

Setting Expectation for the Appointment

At this juncture, you bring the conversation to its purpose: “Basically the purpose of our appointment today is to make sure that you’re receiving all the benefits you’re eligible for and to make sure that your coverage best suits your needs as it relates to medicines, doctors, medical concerns… things like that..”

The First Yes

Following the expectation setting, you should always ask: “Can I ask you a few questions?”

Here’s how you’ll get the first YES! And, after you get the first one, the others will flow much more freely. Also, when a client consents to this request, the agent may ask for whatever they will need to complete the sale. Skip this step, and you’ll be playing catch-up indefinitely and miss more sales than you close.

Positioning Questions

It’s a long-proven fact that sales are made by asking questions more than making statements. Properly positioning insurance products is a process of Q&A. It must be noted that these questions should remain conversational. Otherwise, the client will feel like you’re conducting an interrogation.

Medicare

Before beginning a Medicare discussion involving Medicare Advantage or Prescription Drug Plans, you must acquire a signed Scope of Appointment (SOA) from your client in order to be compliant. Not doing so will result in applications being declined and you losing your credentials to sell Medicare products. No SOA is required when selling ancillary products or not presenting MA’s, MAPD’s, and PDPs.

There are two categories of Medicare Consultation:

T-65 and/or New to Medicare

In this category, you must assess your client’s desire to enroll in Medicare and contrast the value/cost of Medicare to their current coverage. Here are a few pertinent questions to ask them:

- “Are you currently working? If so, do you plan to continue working?”

The reason for asking this question is, if affirmed, to verify that the client has group coverage through their employer/spouse and whether or not they will be permitted to keep that coverage upon becoming eligible for Medicare. If they are not granted the option of keeping group coverage, their decision is obvious. If they do have the option to keep group coverage and delay Medicare, the value/costs of their group coverage should be assessed and compared to Medicare so the client can make an educated decision.

- “Are you planning to start drawing your Social Security benefit at 65, or do you plan to delay it?”

The purpose of asking this question is relevant to the Part B premium. If they are drawing their SS benefit, the premium will be automatically withheld from the SS check. If the SS benefit is delayed, they will have to pay their part B premium one of two ways: quarterly through the mail or monthly via bank draft. “Do you know how Medicare works, and are you interested in any specific type of coverage?”

The intention of this question is to identify the knowledge of the client as it relates to Medicare so you can affirm, correct, and educate your client most effectively on making the right decision.

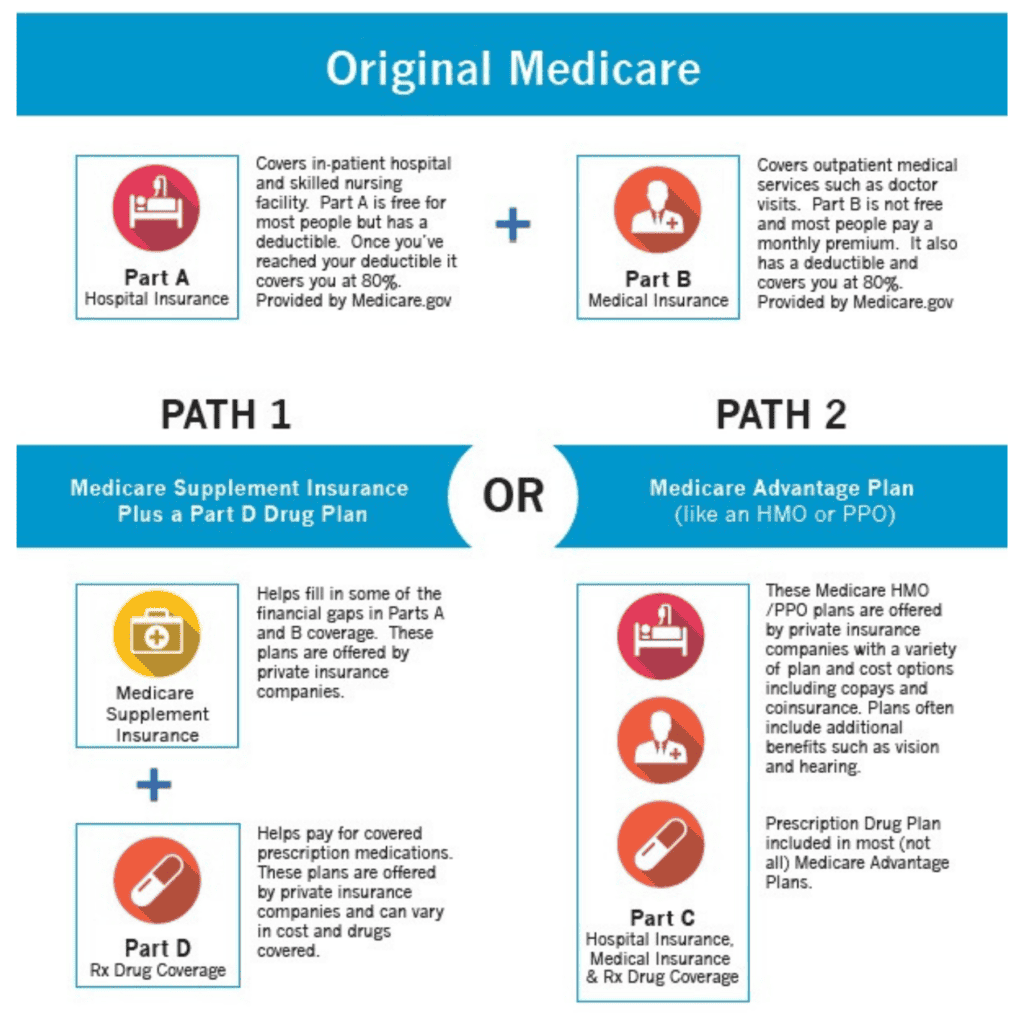

At this juncture, you should educate the client on the two paths of Medicare:

Current Medicare Beneficiary

In this category, the agent must assess the client’s current Medicare coverage as well as their current benefit of/eligibility for extra help. Here are a few pertinent questions to ask them:

- “Do you currently have a Medicare Supplement or Advantage?”

This question is to identify the type of coverage the client currently has and offer updated coverage that would be most beneficial to them.

- “Which plan do you have, and how much is your premium?”

This will help affirm which coverage the client has and whether or not they have any subsidies/extra help.

- “Have you had any trouble with your coverage? . . . Any doctors that refused to accept your plan? . . . Any medicines that your plan refused to cover?”

These questions are to uncover the red-button issues that are important to all Medicare beneficiaries. It is impossible to properly position a coverage upgrade without the information that these questions provide.

- “Are you concerned about the cost of any of your medications?”

This will help solidify whether or not the beneficiary has LIS/Extra Help. While inexpensive medications are not an absolute indicator of Extra help, high copays, and experiencing the Coverage Gap (Donut Hole) is an indicator of not receiving LIS. Questions regarding medication should remain generic and open-ended so as to remain compliant. To absolutely verify, you may do so by checking Medicare.gov or by calling any one of the MA/MAPD/PDP carriers to confirm eligibility.

- “Do you have a QMB or Medicaid Card?”

QMB/Medicaid beneficiaries are eligible for Special Needs plans. Knowing someone’s SNP eligibility is paramount to properly positioning Medicare coverage.

Medications

Whether positioning an MAPD or PDP, this step is paramount to the quality of coverage provided to the beneficiary. It is recommended that you check all of the client’s medications against the formularies of the plans available to them in the region where they live.

“How much monthly income do you receive from your Social Security benefit?… Any other income?” The reasoning behind these questions is to ensure that the benefit level the beneficiary receives matches their income amounts.

The most efficient process of completing this step is using the Enrollment Central platform or medicare.gov. It should also be noted that a medicine not listed on any given formulary is not an automatic disqualifier of coverage, but it should be fully disclosed/discussed when presenting the plan.

In completing this medication check, your goal should be to both educate the client and familiarize yourself with the formularies of the plans you offer. The most user-friendly way to complete this step is by using Enrollment Central.

Doctors

Once the client’s medication needs have narrowed the coverage options, narrow then further by reviewing the client’s doctors. Primary care, specialist physicians, and hospitals should be checked against the network of all potential MA products. We also recommend specifically mentioning pain specialists when completing this step, as some clients do not associate them with customary specialists. In completing this physician check, your goal should be to both educate the client and familiarize yourself with the networks/medical groups covered by the plans you offer. Enrollment Central has direct links to the doctor finder websites hosted by the carriers offering coverage where your client lives.

Benefits

While you shouldn’t use value-adding benefits exclusively to make a sale, it is important to educate the applicant of the full scope of the plan’s value. Making clients aware of options like dental, vision, hearing, and other ancillary coverages is helpful when beneficiaries are selecting their Medicare coverages. Ask questions like:

- “Do you have dental work that needs to be done?”

- “Is your eyewear expensive?”

- “Could you benefit from hearing aid coverage?”

This will give you the information needed to serve the needs of your client best. The Enrollment Central platform is a great tool for comparing coverage benefits.

How to Learn and Know the Products

There is no substitute for product knowledge. Whether offering Medicare coverage, ancillary benefits, or a blend of the two, you must establish yourself as an expert when positioning and presenting products. The best way to do so is to study, practice, then study and practice some more . . . and then do it again.

Read and memorize benefit summaries. Study product brochures. Talk to beneficiaries about how their coverage works. Do presentations with friends or family members and let them scrutinize your knowledge and techniques. Don’t be ashamed to say: “I’m not sure, but I’ll find out.” Finally, make the commitment to yourself that you’ll never stop learning.

Ancillary

Not unlike Medicare products, positioning ancillary products is completed best through a series of questions. The following questions are recommended when preparing to present the following products:

Hospital Indemnity - HI

“Are you concerned about the $ per day copay that you would incur in the event that you were admitted into the hospital?”

This question both informs the client of the risk of loss as well as opens the door for the agent to offer the solution to that risk.

Another good positioning question to ask is: “Did you notice that an ambulance ride with your coverage would cost you $ ?”

Cancer/Hear tAttack Stroke/Critical Illness

“Are you aware that out-of-pocket healthcare costs are a problem for 25% of cancer survivors?”

This question helps the client understand that cancer costs are not limited to treatment and that no medical coverage will eliminate all liability upon diagnosis.

Another good positioning question to ask is: “Approximately 60% of cancer costs are non- medical . . . do you have a cancer benefit to help you cover that?”

Short Term Care (STC)/Home Health Care (HHC)

“If you had to have rehabilitation, would you rather receive that care in your home or in the nursing home?”

This question makes the client aware of both the potential risks of rehab and the potential opportunity to have it at home.

Another good positioning question to ask is: “Did you know that most Medicare Advantage plans charge a daily fee for inpatient rehab after day 20 and the average cost is $170 per day?”

Dental Vision Hearing - DVH

“Have you given any thought to dental, vision, and hearing expenses since Medicare doesn’t cover all of those needs?”

This question brings the client to a comprehensive understanding of what Medicare does and doesn’t cover. It also opens the door for you to provide a benefit that compensates for those risks.

Another good positioning question to ask is: “Were you aware that gum disease (periodontitis) is associated with an increased risk of developing heart disease?”

Life Insurance/Final Expense

“Have you made arrangements for your final expense?”

This question highlights the financial risk of the inevitable. It also presents an opportunity to displace that risk.

Another good positioning question to ask is: “Would your purpose in having a life insurance policy be to cover final expense only, or do you wish to leave a benefit to someone in particular when you pass?”

Making the Presentation

Here we are. This is where your conversation with your client was designed to bring you. Here you present coverage/coverages that have been purposefully positioned to best fit the needs of your client. To be most effective, you should contrast the client’s current coverage (if any) with the coverage update options you’re offering.

During the presentation, watch your client closely. Their expressions and responses to your presentation will confirm what is most important to them. Once the presentation is complete, allow them a moment to consider the information and ask for any questions they may have.

Recap the most important aspects of the coverage and ask: “Does this look good to you?” or: “Do you feel like this coverage would be beneficial to you?” When they say yes, begin the application process.

Staying Compliant

When presenting Medicare Advantage or Prescription Drug Plan coverage, you should always include the following in order to stay compliant:

- A Summary of Benefits.

- Star Ratings.

- A Multi-Language Insert.

Completing the Application

Depending on the product sold, the application process will differ slightly. However, it is most advisable to use electronic application processes when selling both Medicare and non-Medicare products. Doing so helps to eliminate mistakes and rejected applications.

When positioning, presenting, and completing an application for Medicare Supplements, Medicare Advantage, and Prescription Drug Plans, you should use Enrollment Central. It is the most user-friendly process of completing applications. For other products, virtually all carriers offer e-applications through their agent portals. Some also offer IOS and Android apps to complete applications as well.

After the Sale

You’ve done it! After successfully becoming acquainted, positioning the proper product, making a compliant presentation, and completing the sale, you should always, always, ALWAYS ask for referrals. A client marketing for you in the form of a referral is the most efficient way to grow your business. Leave behind business cards, ink pens, notepads, etc. that will serve as a constant reminder of the pleasant interaction you shared with your client.

Follow up as well. A good time to reconnect with your clients is around the time they receive their policy and/or coverage IDs. Also, touching base as the annual renewal of coverage approaches is advisable as well. When your clients share the experience they had with you to their friends and family, your credibility, trustworthiness, and book of business grows. Each agent will be different in their follow up. Our strategy at NCC is to promote a 30/60/90-day follow-up. This ensures a consistent process that you can implement from day one.