Every Medicare and non-Medicare beneficiary should be advised to consider adding ancillary health/life insurance benefits to their coverage portfolio. Unlike Medicare, CMS does not govern these benefits according to age, disability, and/or election/enrollment periods. Therefore, offering them to both your Medicare clients and non-Medicare clients, as well as their friends and family members, is most advisable. The more products you have in effect with a client and their friends/family, the more likely they will be to keep you as their agent. If you don’t sell ancillary products, you are directing your clients to see another agent who could eliminate your place in their coverage portfolio. We’ll say more about providing these benefits effectively in the Sales Techniques portion of this guide.

Hospital Indemnity - HI

Hospital Indemnity insurance is a supplemental (although not a Medicare Supplement) insurance plan designed to pay for the costs of a hospital admission that may not be covered by other insurance. In most cases, MA/MAPD clients purchase HI due to the hospital copays associated with their coverage.

Guarantee Trust Life and Medico are two of the most popular providers of HI coverage in the US. In most cases, HI applicants will answer health-related “Knock-out Questions” as a form of underwriting and be subject to further underwriting after a claim is made. However, GTL, for instance, offers Guaranteed Issue HI coverage to applicants purchasing coverage between the ages of 64 ½ and 68 ½.While the coverage is designed to compensate for expenses incurred as a result of a hospital stay, there are no stipulations on how the beneficiary spends the benefit of an approved claim. Most HI plans can be coupled with riders that provide benefits for other medical needs such as ambulance costs, cancer, rehabilitation, and outpatient care.

Critical Illness/Cancer/Heart Attack Stroke

Critical illness coverage has increased in viability and popularity over the past several years. It is advisable for adult clients of all ages, including both MA and Med Supp beneficiaries. While some carriers offer treatment plans, “Lump Sum” benefit policies are generally recommended. In most cases, critical illness applicants will answer health-related “Knock-out Questions” as a form of underwriting and be subject to further underwriting after a claim is made.

Upon approval of a claim, which is triggered by diagnosis, there are no stipulations on how the beneficiary spends the benefit. As increased value add-ons, some carriers offer optional plan riders that cover specified diseases such as Alzheimer’s, Dementia, ALS, End-Stage Renal Failure, MS, and Coma.

Short Term Care (STC)/Home Health Care (HHC)

Short-term policies typically cover home care or assisted living when the beneficiary can’t take care of themself. But instead of paying for years of care, short-term care insurance, also known as recovery care, typically provides benefits for 12 months or less.

Most commonly, short-term care insurance is used to cover gaps in Medicare coverage or as an alternative option to inpatient rehab and long-term care insurance. Guarantee Trust Life’s STC/HHC plan also offers riders that cover ambulance expenses, as well as a medication reimbursement that helps offset the cost of the coverage.

Dental Vision Hearing (DVH)

Dental, Vision, and Hearing insurance provides additional coverage for fillings, extractions, cleanings, contact lenses, eyeglasses, hearing aids, and more. Plans will have a maximum aggregate payout of $1,000 or $10,000 per year. Some operate as indemnity coverage, while others offer network-based coverage. Some plans function both ways.

Life Insurance /Final Expense

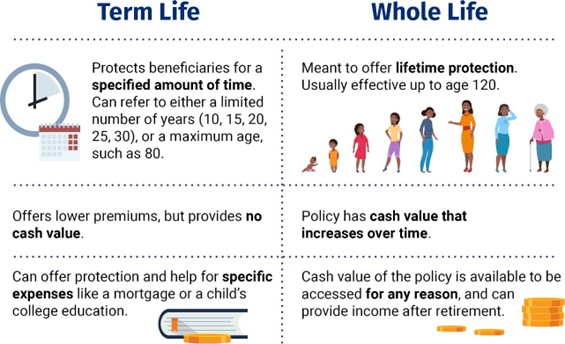

Although the majority of sales that a Medicare agent produces will be health-based, it is most advisable to be prepared to serve your clients’ Life Insurance/Final Expense needs as well. Basically, the most common products you’ll offer will be either Term or Whole Life policies.

As you can see in the illustration, the majority of your Medicare clients will benefit most from Whole Life rather than Term coverage. Most commonly, life insurance purchasers older than 60 purchase whole-life coverage to alleviate final expenses that would otherwise be left for the surviving family and friends to pay.

Based on the applicant’s health, the agent can advise what level of underwriting will be suitable for the insured. Multiple carriers offer underwritten coverages that provide full death benefit upon issue of the policy, while others offer Guaranteed Issue policies that require no underwriting questions to be answered but pay a decreased death benefit the first few years of the policy’s life. Both policy types have their place, and a knowledgeable agent doing appropriate field underwriting will offer the correct option.

Several different carriers offer an array of life products. The most prominent would be Mutual of Omaha, Pekin, Gerber, and Assurity.

It should be noted that it is not compliant to offer and sell life products in conjunction with Medicare products. An agent authorized to sell both should schedule a separate appointment allowing at least 72 hours to pass in between the sale of the two products in order to remain compliant.