Retire on Medicare Renewals

“If you want to retire on your renewals, you can’t do it selling life insurance. You have to sell Medicare.”

– Connie Floyd, Top NCC Marketing Specialist

Why Sell Medicare? Financial Stability

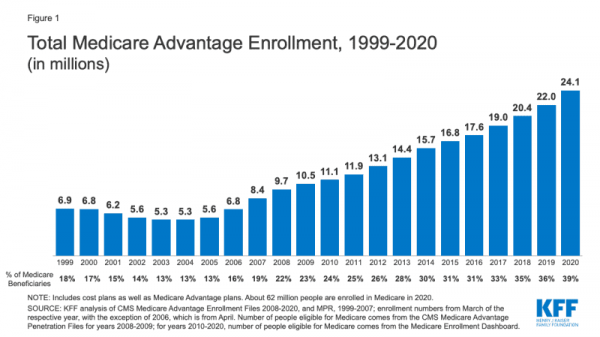

Medicare is a growth industry with long-term earning potential, especially for agents who diversify by selling Medicare Supplements and ancillary products. The numbers don’t lie.

10,000 People Per Day Turn 65 in the United States

Few other industries offer the balance of growth and stability you find when you sell Medicare. With baby boomers aging in, Medicare enrollment rates are expected to continue growing well into the 2030’s.

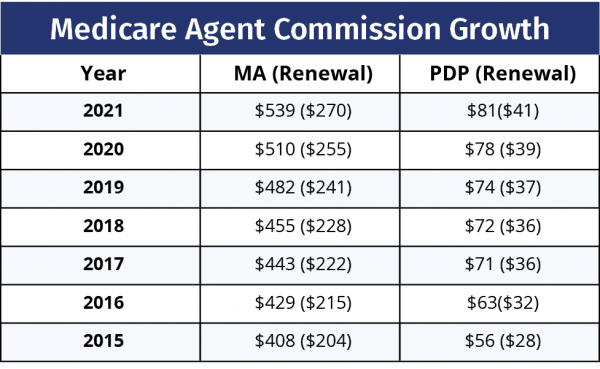

Medicare Commissions Increase Steadily Each Year

In 2021 an agent earns $539 for enrolling a new recipient in a Medicare Advantage plan, and $270 for a renewal.

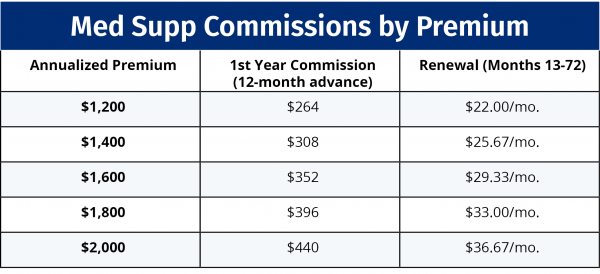

When You Sell Medicare Supplements, You Can Earn Even More Commissions

The average yearly premium for Medicare Supplement plans is $1,600, and the commission rate is 22%.

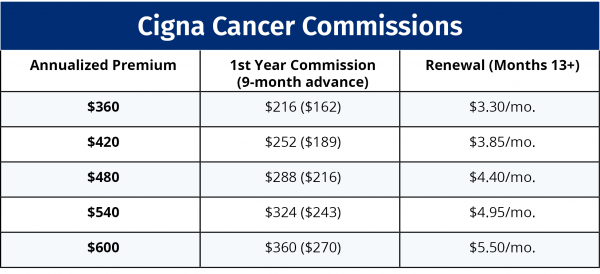

Earn More by Selling Ancillaries

You get an advance on any new ancillary policy you sell, making ancillaries a great bet for newer agents, or for an experienced agent looking to balance commissions throughout the year.

Take a look at the advances and commissions you earn by selling ancillary policies to your clients in addition to Medicare products:

The average premium on a Cigna Cancer plan is $420/year. Commission is 60% in the first year and 11% afterward, with a 9-month advance.

Why Sell Medicare? To Secure Your Retirement

Like Connie said, life insurance commissions won’t get you through retirement. Medicare’s commission structure and ability to grow commissions with ancilllary products make selling Medicare a smart choice.

Not Sure How to Sell Medicare?

Our Medicare Sales Training Guide for agents has everything you need to get started selling Medicare, from contracting and licensing to sales and marketing techniques. Or you can reach out to our team to have all of your questions about selling Medicare answered.