Life Insurance Guide

Final Expense & Life Insurance Basics

Points of Interest

Introduction

The Purpose of Life Insurance

The first topic we will explore in NCC’s Guide to Life Insurance is the purpose of Life Insurance. Your clients’ need for life insurance will vary with age and responsibilities. The amount of insurance your client buys should depend on the standard of living they wish to ensure for their dependents. You should consider the amount of assets and sources of income available to your client’s dependents if they were to pass away. Social security benefits, available cash and other sources of income and investments may not provide the standard of living they have in mind. Life insurance helps bridge the gap between the financial needs of their dependents and the amount available from other sources.

- Income protection

- Final Expense Coverage

- Legacy Preservation

Client Considerations

Before They Buy Life Insurance...

The purchase of life insurance is an important decision for your clients and is purchased for many reasons.

- Personal & Family Needs: # of dependents & income replacement

- Financial Obligations: mortgage, debts, loans.

- Health & Insurability: chronic conditions, family history

- Employment Consideration: life insurance portable?

- Future Financial Goals: children’s college, legacy, charity

- Final Expenses: funeral costs, would the family struggle to pay?

- Budget & Affordability: what can they truly afford monthly

- Long Term Planning: estate planning & taxes, wealth transfer

Life Insurance Guide – Quick Tip

Most Importantly

- Provides financial security for the ones they love

- covers their final expenses and any debts.

Choosing the Right Type of Life Insurance

Guiding your clients

One approach to take when guiding clients is to focus on the wage earner(s).

- Pay off an individual’s last debts such as medical bills and funeral expenses.

- Meet estate taxes and other expenses in settling an estate

- Provide life income for the spouse

- Pay off a mortgage

- Pay for the children’s education

- Provide funds for retirement

- Provide an income for the policyholder’s spouse to give the family time to readjust to a new standard of living

- Draw interest to provide funds for some special purpose

- Provide a monthly income until the children are grown and out of school

Life Insurance Guide – Quick Tip

The 10 X’s Rule: death benefit should be ten x’s their annual earnings

When to Purchase

Final Expense Life Insurance

The right time to purchase a Final Expense Insurance policy depends on Your Clients financial situation, health status, and overall estate planning goals.

As Early as Possible (50s or Early 60s)

- Premiums are lower when they’re younger and healthier.

- More policy options with better coverage.

- They lock in affordable rates before potential health issues arise.

When You Have No Other Life Insurance Coverage

- If their term life policy has expired or they never had a policy, final expense insurance can cover funeral costs, medical bills, and small debts.

If You Have Limited Savings for End-of-Life Costs

- If their family would struggle to cover funeral and burial expenses, a final expense policy ensures they won’t have to shoulder the financial burden.

After a Major Health Diagnosis

- Final expense insurance often does not require a medical exam, making it a good option if they develop a condition that disqualifies them from traditional life insurance.

Life Insurance Guide – Quick Tip

When You Might Not Need It

- If you have sufficient savings or pre-paid burial plan.

- If your existing life insurance is enough to cover funeral costs.

When to Purchase

Term Life Insurance

The right time to purchase Term Life Insurance depends on personal and financial situations, but generally, the earlier, the better.

When You Have Dependents

- Have a spouse, children, or other family members who depend on their income

When You Get Married

- If spouse relies on their income, this can help cover living expenses, mortgage payments, and future financial goals.

When You Buy a Home or Have Major Debt

- Have a mortgage, car loan, or other debts. Protect loved ones from the burden.

When You’re Young and Healthy

- Premiums are lower when client is younger and in good health. Health issues could develop.

When You Start a Business

- can help protect their business partners and employees by covering debts or facilitating a buyout if they pass away.

Life Insurance Guide – Quick Tip

Bottom Line with Term

If they have financial obligations or people depending on them, it’s a good time to consider purchasing term life insurance. The earlier they get it, the cheaper and easier it usually is.

When to Purchase

Universal Life Insurance

The right time to purchase Universal Life (UL) insurance depends on their financial goals, needs, and stage of life.

Permanent Coverage with Flexibility

- Provides lifelong coverage.

- Allows flexible premium payments.

- It ever expires and offers adjustable payments.

Have Dependents or Estate Planning Needs

- Have young children, a spouse, or aging parents who depend on their income

- Have a large estate, can help cover estate taxes and pass on wealth.

Looking for Cash Value Growth

- Includes a cash value component that grows over time, tax-deferred.

- If they want a policy that builds wealth, can be borrowed against, or used to supplement retirement income

Need Business Protection

- Can be used for Key person insurance & Buy-sell agreements

Tax Advantages

- The cash value grows tax-deferred.

- Death benefits are generally tax-free to beneficiaries.

- Policy loans are tax-free if managed properly.

Life Insurance Guide – Quick Tip

When It May NOT Be the Right Time

- Just need temporary coverage

- On a tight budget

- Not sure about long-term commitments.

Disclose the

“Free Look Period”

The “Free Look Period” is a set number of days (usually 10 to 30 days, depending on the state) after a life insurance policy is delivered, during which the client can cancel the policy for a full refund.

- Purpose: It gives the client time to review the policy in detail, consult with family or advisors, and ensure it meets their needs.

- Refund Guarantee: If the client cancels within the free look period, they’ll receive a 100% refund of any premiums paid.

- Start Date: Clarify that the period usually begins on the date the policy is delivered, not the date it was applied for or approved.

- Build Trust & Transparency

- Prevent Buyers Remorse

- Ensures Compliance

- Avoids Complaints

Most Common

Key factors in needing life insurance

Income Replacement

- If family members depend on their earnings, life insurance ensures they have financial support after clients passing.

Debt Coverage

- To prevent debts(e.g., mortgages, car loans, personal loans) from becoming a burden on surviving family members.

Final Expenses

- Helps cover funeral costs and medical bills, which can be significant.

Estate Planning

- Assists in preserving wealth and ensuring a smooth transfer of assets to heirs.

Business Continuity

- Businessowners may need life insurance to fund buy-sell agreements or protect against the loss of a key person.

Education & Future Expenses:

- Can help ensure children’s education costs and future financial needs are met.

Life Insurance Guide - Suitability

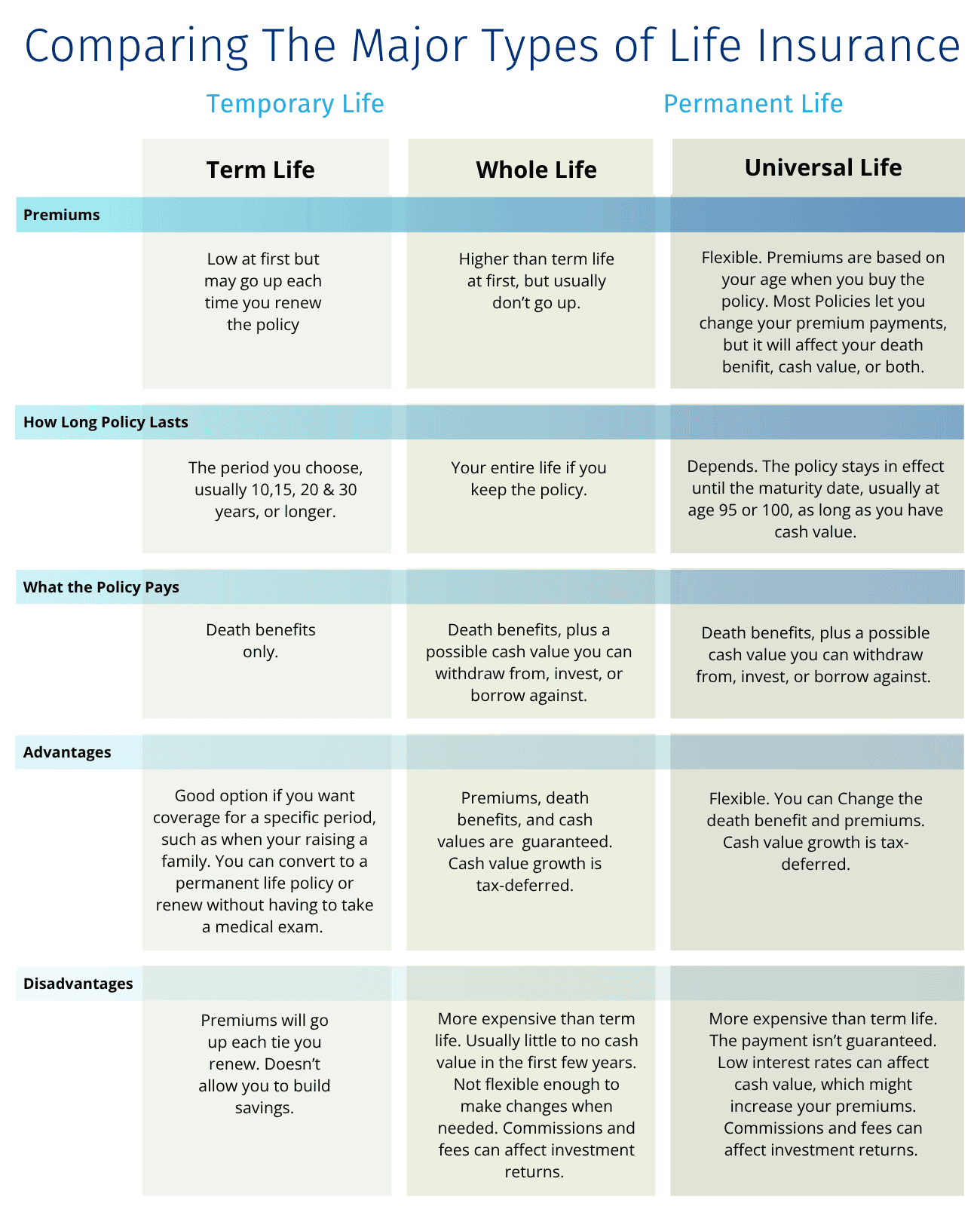

There are different types of life insurance policies, each catering to different needs

Term Life

Best for temporary coverage

- Provides coverage for a fixed period (e.g., 10, 20, or 30 years).

- Suitable for those seeking affordable coverage to protect dependents.

- No cash value; only pays out if the insured dies within the term.

Whole Life

Best for lifelong coverage and wealth building

- Provides lifelong coverage with a cash value component that grows over time.

- Suitable for individuals looking for estate planning, tax advantages, and financial security.

Universal Life

Flexible coverage with an investment component

- Combines life insurance with investment growth potential.

- Suitable for those who want flexible premiums and cash value accumulation.

Final Expense

Best for covering funeral and end-of-life costs

- Designed for seniors to cover burial and medical expenses.

- Suitable for those without other financial resources for final expenses.

Insurable Interest

a fundamental requirement in life insurance policies

Prevention of Fraud

- It prevents individuals from taking out policies on strangers or unrelated people for financial gain.

Protection Against Harm

- Requiring insurable interest helps deter situations in which someone might have an incentive to harm the insured.

Risk Management for Insurers

- Insurance companies need to ensure that policies are purchased for valid reasons and not for speculative or gambling purposes.

Legal and Ethical Considerations

- Without insurable interest, life insurance could be misused, leading to scenarios where people profit from another’s death without a legitimate connection.

Typically, family members (spouses, children, parents, etc.) and business partners have an insurable interest. In some cases, insurable interest must exist when the policy is issued, but not necessarily when a claim is made.

Life Insurance Guide – Quick Tip

Meant to prevent financial exploitation and ensure the policy is taken out for legitimate purposes. A beneficiary must have an insurable interest in policy holder, meaning they would suffer a financial or emotional loss if the beneficiary were to pass away.

Types of Life Insurance

Guaranteed Issue (GI)

- This type of policy is a last resort for people who cannot qualify for other types of life insurance coverage.

- Those who are permanently disabled, have serious health issues, or have a mental disorder, collecting social security, SSI, for guaranteed issue life may be their best option.

- Available to those aged 50-80 years

- No medical exam required

Guaranteed Universal Life (GUL)

Guaranteed Universal Life (GUL) is a type of permanent life insurance that combines the affordability of term life insurance with the lifelong coverage of whole life insurance, without the investment component of traditional universal or whole life policies.

- Guaranteed death benefit: Pays a fixed amount to beneficiaries as long as premiums are paid

- Lifelong coverage: Can be designed to last to a specific age (e.g., 90,95, 100, or even 121).

- No cash value accumulation: Unlike whole life or standard universal life, GUL builds minimal or no cash value.

Level premiums: Fixed payments that do not increase with age or health changes.

Lower cost: Typically, more affordable than whole life insurance.

Term Life Insurance

- Can purchase coverage for a certain number of years at their current age and other life factors.

- Term is like renting… Their policy will renew after 10 years, 20 years, or 30 years.

- Cheapest form of life insurance.

- Rate classes – standard, preferred, preferred best, standard plus – smoker, tobacco user.

- Hobby and occupation play a part in the premium rate class.

- Some carriers require medical exams, while others do not. If a customer is willing, it can save on premium costs.

Whole Life

Permanent Insurance that pays guaranteed death benefits

Level Premiums:

- Limited pay life insurance – pay premiums for 10,15, or 20 years

- Single premium life – one payment, lifetime benefits

- Guaranteed Issue Final Expense

- Guaranteed Issue Whole Life

Benefits:

- Builds cash value over time, tax-deferred.

- It can be used for loss of income, help with mortgage costs, or educational needs.

- Lifelong coverage if premiums are paid

Optional Policy Benefits / Riders

At the time your client purchases a life insurance policy certain supplemental benefits are available.

- may be an additional charge

- may require evidence of insurability.

Waiver of Premium

- Waives their life insurance premiums if they become totally disabled and unable to work

- Allows their coverage to remain active without payment, protecting your policy even if their income stops.

- Most policies have a waiting/elimination period (typically 3 to 6 months) before the rider takes effect.

Some policies require the disability to occur before a certain age (often age 60 or 65).

Automatic Premium Loan Provision

- At the end of the grace period, if the premium due has not been paid, a policy loan will automatically be made from the policy’s cash value to pay the premium.

- Helps to prevent an unintentional lapse in the policy.

The value of the cash surrender must at least equal the loan amount plus a year of interest.

The policyowner must elect this provision and can be cancelled at any time by the policyowner.

Waiver of Mortality Deduction Charges

- Works the same as Automatic Premium Loan Provision, except this is offered with flexible premium Universal Life type policies

Disability Income

- Provides a monthly income while they are totally disabled after an initial waiting period.

- The monthly disability income benefit is limited to a percentage of the death benefit.

Accidental Death Benefit

- Provides an additional amount of insurance in the event that the insured’s death occurs by accident.

- The accidental death must occur before a specified age, such as 65.

- Some provide two or three times the face amount of the policy for specified types of accidents.

- Among other exclusions, death due to sickness is excluded.

Guaranteed Insurability

- Allows client to buy a stated amount of additional insurance at specified intervals up to a maximum age, usually 40, without presenting evidence of insurability

- Provides alternate dates to obtain additional insurance:

- marriage

- birth or adoption

- Guarantees the option of buying additional coverage regardless of the state of their health when they request the additional insurance at premium rates based on their attained age.

Cost of Living Rider

- Enables them to purchase more insurance each year to help offset increasing insurance needs due to inflation.

- The amount that can be purchased is based on increases in the cost-of-living index.

- This additional coverage is usually available at low rates, and evidence of insurability need not be provided for such increases.

Term Riders

- Provide temporary coverage, which may be attached to an existing permanent or interest-sensitive policy to provide extra insurance protection for a fixed period of time.

- Useful if they need more insurance or a decreasing amount of coverage for a limited period.

Payor Benefit Rider

- This may be added to a juvenile’s policy stating that if the payor (the one paying the premium) dies or becomes disabled before the juvenile reaches majority, the subsequent premiums due are automatically waived.

Spouse Rider

- Will provide level term coverage on the life of the insurer’s spouse.

- Also provides a conversion provision permitting the spouse to convert to permanent coverage without evidence of insurability before the rider’s termination or upon the insured’s death under the basic policy.

Children’s Rider

- Will generally provide level term coverage on the lives of children.

- Usually offered at one premium rate and may cover newborns and adopted children who can be added to the coverage without increasing their premium.

- Will also provide a conversion provision, which will permit each child to convert to a permanent plan of coverage without evidence of insurability prior to the rider’s termination or upon the insured’s death under the basic policy.

Life Insurance Guide – Quick Tip

Most riders are not automatically included—it/they must be requested and added at the time of application or during underwriting.

Premiums

Life insurance premiums are calculated based on several key factors that help insurers assess the risk of insuring an individual. The higher the perceived risk, the higher the premium.

Here’s a breakdown of the main factors that influence life insurance premiums:

Personal Factors

- Age – Younger individuals generally pay lower premiums because they are less likely to pass away soon.

- Gender – Women typically have lower premiums since they tend to live longer than men on average.

- Health History – Pre-existing conditions, chronic illnesses, and medical history impact premium rates.

- Family Medical History – If close relatives have had serious illnesses like heart disease or cancer, premiums may be higher.

- Lifestyle & Habits – Smoking, excessive drinking, and risky behaviors (e.g., skydiving, racing) can lead to higher rates.

- Occupation – Dangerous jobs (e.g., firefighters, construction workers) may increase premiums.

Policy-Specific Factors

- Term Life Insurance usually has lower premiums since it covers a fixed period.

- Whole Life or Universal Life policies have higher premiums due to their lifelong coverage and cash value component.

- Coverage Amount (Death Benefit) – Higher payouts result in higher premiums.

- Policy Term Length – Longer-term policies tend to have higher premiums.

- Riders & Add-ons – Additional benefits (e.g., waiver of premium, accidental death coverage) increase the cost.

Underwriting & Risk Classification

- Insurance companies use underwriting to classify individuals into risk categories:

- Preferred Plus – Best health, lowest premiums.

- Preferred – Very good health, slightly higher premiums.

- Standard – Average health, higher premiums.

- Substandard – Higher-risk individuals with the highest premiums.

- Some policies, like Guaranteed Issue Life Insurance, do not require medical exams but have significantly higher premiums.

- Insurance companies use underwriting to classify individuals into risk categories:

Market & Economic Factors

- Interest rates, investment returns, and the insurer’s financial outlook can impact pricing.

- Competition among insurance companies can also influence premium rates.

Claims Process

Understanding the Life Insurance Claims Process

As a Medicare agent stepping into life insurance, it’s important to understand the claims process so you can confidently educate your clients and set accurate expectations.

The life insurance claim is the process by which a beneficiary receives the policy’s death benefit after the insured passes away.

Your role isn’t to process the claim, but by explaining how it works, you build trust and demonstrate professionalism. Initiating the Claim

Claim & Death Certificate: the beneficiary must notify the insurance company and submit a claim form, along with a certified copy of the death certificate.

Most carriers offer downloadable forms online or through the agent portal.Contestability Period: If the death occurs within the policy’s contestability period (usually the first two years), the insurance company may conduct a more detailed review, including medical records. This isn’t a denial—just due diligence to verify that all information provided during the application was accurate.

Understanding the Life Insurance Claims Process

- Once the claim and required documents are submitted, the insurer begins the review.

- Turnaround time can be as quick as 7–14 business days.

- If further investigation is required— such as for accidental death, recent policy issuance, or missing documentation—it may take longer.

Benefit Payout and Client Support

If Approved: death benefit is typically paid as a lump sum, though some policies offer alternate payout options.

Assisting Beneficiary: After the claim is paid, you may also assist clients with beneficiary changes on existing policies or policy reviews for surviving family members.

Life Insurance Guide – Quick Tip

Prepare Yourself & Client

A strong grasp of the claims process not only helps your clients—it positions you as a trusted resource for life insurance solutions.

Life Insurance Guide - Glossary

Frequently used industry terms

Agent – An insurance company representative licensed by the state who solicits and negotiates contracts of insurance and provides service to the policyholder for the insurer. An agent can be an independent agent who represents at least two insurance companies or a direct writer who represents and sells policies for one company only.

- Annuity – A contract that provides a periodic income at regular intervals, usually for life.

- Annuity Certain – A contract that provides an income for a specified number of years, regardless of life or death.

- Application – A statement of information made by a person applying for life insurance. It helps the life insurance company assess the acceptability of risk. Statements made in the application are used to decide on an applicant’s underwriting classification and premium rates.

- Beneficiary – The person named in the policy to receive the insurance proceeds at the death of the insured. Anyone can be named as a beneficiary.

- Bonus Rate Annuity – An extra percentage of interest credited to an annuity during the first year that is in force. The extra amount is above the interest rate to be credited beginning the second year and the remaining years that the annuity is in force. The extra rate is paid in the first year in an effort to attract new policyholders.

- Cash Surrender Value – The amount available in cash upon voluntary termination of a policy by its owner before it becomes payable by death or maturity. The amount is the cash value stated in the policy minus a surrender charge and any outstanding loans and any interest thereon.

- Direct Response – Insurance sold directly to the insured by an insurance company through its own employees by mail or over the counter.

- Disclosure Statement – A comparison form required by New York Department of Financial Services Regulations to be given to every applicant considering replacing one life insurance policy with another.

- Dividend – A return of part of the premium on participating insurance to reflect the difference between the premium charged and the combination of actual mortality, expense and investment experience. Dividends are not considered to be taxable distributions because they are interpreted as a refund of a portion of the premium paid.

- Evidence of Insurability – A statement or proof of your health, finances or job, which helps the insurer decide if you are an acceptable risk for life insurance.

- Expense – Your policy’s share of the company’s operating costs-fees for medical examinations and inspection reports, underwriting, printing costs, commissions, advertising, agency expenses, premium taxes, salaries, rent, etc. Such costs are important in determining dividends and premium rates.

- Face Amount – The amount stated on the face of the policy that will be paid in case of death or at the maturity of the policy. It does not include additional amounts payable under accidental death or other special provisions, or acquired through the application of policy dividends.

- Free Look Provision – A certain amount of time provided (usually between 10-30 days) to an insured in order to examine the insurance policy and if not satisfied, to return it to the company for a full refund.

- Insurable Interest – For persons related by blood, a substantial interest established through love and affection, and for all other persons, a lawful and substantial economic interest in having the life of the insured continue. An insurable interest is required when purchasing life insurance on another person.

- Lapse Rate – The rate at which life insurance policies terminate because of failure to pay the premiums. When policies are lapsed before enough premium payments are made to cover early policy expenses, the company must make up this loss from remaining policyholders. Therefore, the lapse rate will affect the cost of the policy.

- Life Expectancy – The probability of an individual living to a certain age according to a particular mortality table. This is the beginning point in calculating the pure cost of life insurance and annuities and is reflected in the basic premium.

- Misstatement of Age – The falsification of the applicant’s birth date on the application for insurance. When discovered, the coverage will be adjusted to reflect the correct age according to the premium paid in.

- Mortality – The incidence of death at each attained age; frequency of death.

- Non-Forfeiture – One of the choices available if the policy owner discontinues premium payments on a policy with a cash value. Options available are to take the cash value in cash or to use it to purchase extended term insurance or reduced paid-up insurance.

- Non-Participating – A life insurance policy in which the company does not distribute to policyowners any part of its surplus.

- Participating Policy – A life insurance policy under which the company agrees to distribute to policyowners the part of its surplus that its Board of Directors determines is not needed at the end of the business year. The distribution service serves to reduce the premium the policyowners have paid.

- Policy – The printed legal document stating the terms of the insurance contract that is issued to the policyowner by the company.

- Policy Proceeds – The amount actually paid on a life insurance policy at death or when the policyowner receives payment at surrender or maturity.

- Policyowner – The person who owns a life insurance policy. This is usually the insured person, but it may also be a relative of the insured, a partnership or a corporation.

- Premium – The payment, or one of the periodic payments, a policyowner agrees to make for an insurance policy. Depending on the terms of the policy, the premium may be paid in one payment or a series of regular payments, e.g., annually, semi-annually, quarterly or monthly. The premium charged reflects the expectation of loss, expenses and profit contingencies.

- Rating – The basis for an additional charge to the standard premium because the person insured is classified as a greater than normal risk usually resulting from impaired health or a hazardous occupation.

- Reduced Paid-up Insurance – A form of insurance available as a non-forfeiture option. It provides for continuation of the original insurance plan, but for a reduced amount, without further premiums.

- Reinstatement – Restoring a lapsed policy to its original premium paying status, upon payment by the policy owner, with interest, of all unpaid premiums and policy loans, and presentation of satisfactory evidence of insurability by the insured.

- Rider – An endorsement of an insurance policy that modifies clauses and provisions of the policy, including or excluding coverage.

- Risk Classification – The process by which a company decides how its premium rates for life insurance should differ according to the risk characteristics of individuals insured (e.g., age, occupation, sex, state of health) and then applies the resulting rules to individual applications.

- Settlement Options – The several ways, other than immediate payment in cash, in which a policyholder or beneficiary may choose to have policy benefits paid. These options typically include the following:

- Interest Option – death benefit left on deposit at interest with the insurance company with earnings paid to the beneficiary annually.

- Fixed Amount Option – death benefit paid in a series of fixed amount installments until the proceeds and interest earned terminate.

- Fixed Period Option – death benefit left on deposit with the insurance company with the death benefit plus interest paid out in equal payments for the period of time selected.

- Life Income Option – death benefit plus interest paid through a life annuity. Income continues under a straight life income option for as long as the beneficiary lives or whether or not the beneficiary lives, under a life income with period certain option.

- Standard Risk – The classification of a person applying for a life insurance policy who fits the physical, occupational and other standards on which the normal premium rates are based.

- Substandard Risk – The classification of a person applying for a life insurance policy who does not meet the requirements set for the standard risk. An additional premium is charged on substandard risks to provide for the probability that such a person will have a shorter life span than a standard risk.

- Supplementary Contract – An agreement between a life insurance company and a policyowner or beneficiary in which the company retains at least part of the cash sum payable under an insurance policy and makes payment in accordance with the settlement option chosen.

- Underwriter –

The person who reviews the insurance application and decides if the applicant is acceptable and at what premium rate.

- Underwriting –

The process by which a life insurance company determines whether it can accept an application for life insurance, and if so, on whatbasis, so that the proper premium is charged.