As an agent, you know that even when a client has Medicare, they can still be financially devastated by an unexpected hospital stay, particularly if that stay is an extended one. You can protect your clients from this potential financial hardship with a Hospital Indemnity Plan.

The Cost of a Hospital Stay

An unplanned expense like a hospital stay can be devastating to anyone, but especially to a senior citizen on a fixed income. A Hospital Indemnity Plan, however, can help protect your clients from financial uncertainty should the worst occur.

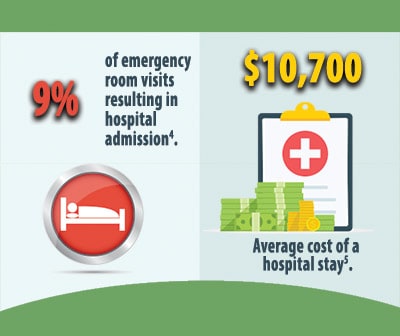

The average cost of a visit to the emergency room is $1,233. After an inpatient stay, your clients could expect to pay far more. The National Institutes of Health estimate the cost of the average hospital stay to be $10,700 before insurance, which could leave your clients with a bill of $2,000 or more.

Medicare and Hospital Costs

Your clients may be expecting that their current Medicare coverage protects them from high hospital bills. While that’s true to a point, there are limits to what’s covered even with a Medicare Advantage plan. The typical MA plan includes a copay of between $100 and $300 for the first six days of a hospital stay.

Even with a Medicare Supplement that covers hospital costs, services deemed non-medical like transportation and meals aren’t included in this coverage. A Hospital Indemnity Plan, however, gives your clients cash to use however they see fit.

Policy Options for Hospital Indemnity

The Advantage Plus Hospital Indemnity Plan from Guarantee Trust Life (GTL) is a la carte. The amount and period of Hospital Indemnity benefit can be tailored to your client, and GTL’s plan is Guaranteed Issue for those aged 64 and a half to 65 and a half. The plan pays up to $600 per day, covers observation stays, and pays benefits directly to the policyholder.

Learn more about GTL’s Advantage Plus Hospital Indemnity Plan on our GTL page, or find more ancillary product recommendations in our guide to the 5 Best Ancillary Products for Medicare Sales.

Sources:

4. Centers for Disease Control (CDC). National Hospital Ambulatory Medical Care Survey: 2015 Emergency Department Summary Tables.

5. National Institutes of Health (NIH). “How Much Will I Get Charged for This?” Patient Charges for Top Ten Diagnoses in the Emergency Department.

6. Business Insider. The 35 most expensive reasons you might have to visit a hospital in the US — and how much it costs if you do.