“If you want to retire on your renewals, you can’t do it selling life insurance. You have to sell Medicare.”

– Connie Floyd, Top NCC Marketing Specialist

Facts About Medicare

- 10,000 people per day turn 65 in the United States.

- With baby boomers aging in, Medicare enrollment rates are expected to continue growing well into the 2030s.

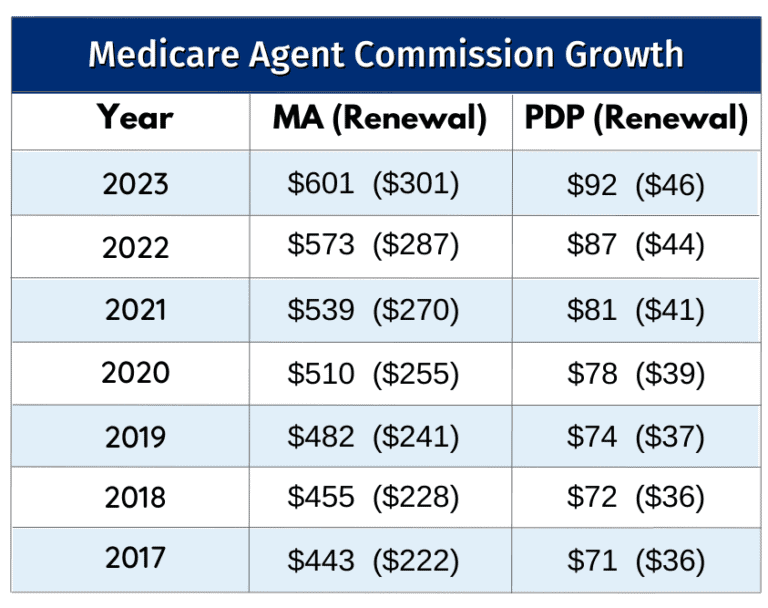

- Between 2015 and 2021, Medicare Advantage and PDP commissions and renewal commissions increased 32%.

What are Original Medicare, Medicare Supplement, Medicare Advantage, and Prescription Drug Plans?

Original Medicare

Original Medicare (also known as Medicare Part A and B) is what people think of when they hear the word Medicare. Medicare is provided by the government. Part A covers hospitalization. Part B covers preventive services, medically necessary services, and doctor visits.

Medicare Supplement (Med Supp)

Medicare Supplement is an addition to Original Medicare. It fills in some of the gaps in Original Medicare, which is why it’s sometimes called Medigap. Medicare Supplements reduce or eliminate most Medicare co-pays and deductibles, such as Part A’s $1,484 hospitalization deductible and Medicare Part B’s 20% coinsurance. Medicare Supplements do not include drug coverage.

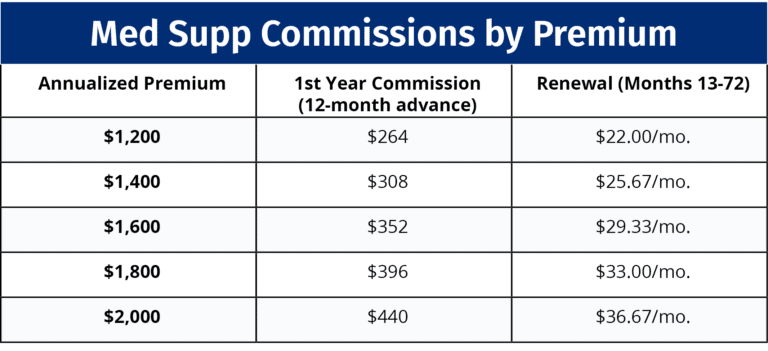

Medicare Supplement Commissions

The average Medicare Supplement commission rate is 22% with a 12-month advance. The average yearly premium for Medicare Supplement plans is $1,600, which has a renewal rate of $29.33/month. Agents can earn renewal commissions for at least six years.

Medicare Advantage (MA)

Medicare Advantage (also called Medicare Part C) replaces Original Medicare. These policies provide the same benefits as Original Medicare, as well as additional coverage. Each plan is different, but MA policies may include dental, vision, hearing, transportation, meals, and other benefits. Most importantly, almost all plans include a Prescription Drug Plan. Some MA plans have $0 premiums.

Medicare Advantage Commissions

2023 commissions for most U.S. states are $601 for persons new to Medicare and $301 for renewals. Commissions are even higher in some U.S. states like California. Commissions are paid in advance. Renewal commissions stay level for the life of the policy.

Prescription Drug Plans (PDP)

PDPs (also called Medicare Part D) add drug coverage to Original Medicare, which with very few exceptions does not cover drug costs.

PDP Commissions

2023 commissions are $92 for persons new to Medicare and $46 for renewals. Commissions are paid in advance. Renewal commissions stay level for the life of the policy.

Medicare Advantage and PDP Renewals - 50% of Original Commission Every Year, Forever

Unlike other forms of insurance, Medicare Advantage and PDP commissions are set by the government. You earn the same commission no matter which carrier’s products you sell.

There’s no limit to the number of years you can earn renewal commissions, and the commissions will never go down. Just the opposite, in fact. Medicare Advantage commissions tend to increase every year. That includes renewals: with an increasing number of carriers, you earn the renewal commission for the current year, not the year you sold the policy.

Between 2017 and 2023, the new-to-Medicare commission increased from $443 to $601, and the renewal commission increased from $222 to $301. That’s a 36% increase in just six years! We can’t speak for everyone, but to us, a one-third pay raise over six years sounds pretty good!

Earn More by Selling Ancillaries

When you talk to clients and prospects about Medicare Advantage, you can also talk about ancillary health products, such as hospital indemnity, long-term care, and cancer, heart attack, and stroke coverage. You’ve already done the work to get the lead, and you’ve already driven to their house, so ancillary sales are pure profit.

Many agents sell an ancillary plan with every third or fourth Medicare Advantage appointment, boosting their income 20% or more. We show you how to do the same in 5 Best Ancillary Products for Financial Peace.

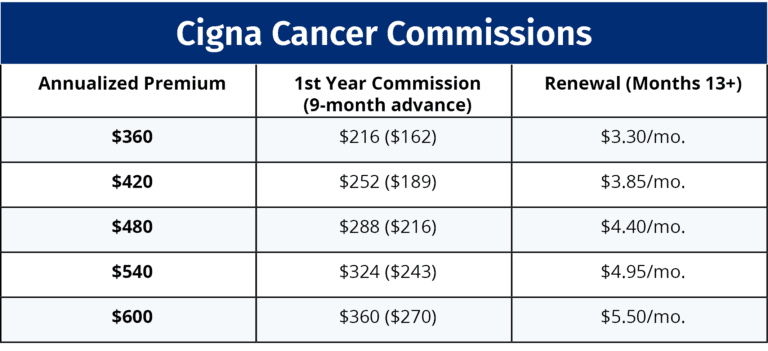

Example: Cigna Cancer Commissions

The average premium on a Cigna Cancer Plan is $420/year. Commission is 60% in the first year and 11% afterward, with a 9-month advance.

Why Sell Medicare? To Secure Your Retirement

Medicare’s commission structure and ability to grow commissions with ancillary products make selling Medicare a smart choice now. It’s an even smarter choice long term. Take a look at the numbers:

- Retire with 100 clients on your books, and you’ll be earning $30,100 a year in renewal commissions.

- Make it 250 clients, and you’ll be earning $75,250 a year in retirement.

- With 500 clients, you’ll retire with an income of $150,500 annually, just from Medicare sales commissions.

After a lifetime of selling insurance, you deserve to retire with financial peace. Like Connie said, life insurance commissions won’t get you through retirement. Medicare Advantage and PDP commissions that stay level for the life of the policy will.