Medicare Supplement Insurance, or Medigap Insurance policies, provide additional coverage for medical expenses Original Medicare does not cover. They provide help with copayments, coinsurance, and deductibles.

Clients may purchase Medicare Supplements at any time during their Initial Enrollment Period or after if they can go through underwriting. They may also apply if they are under 65 and have a disability or ESRD, and are not currently enrolled in an MA Plan.

If they are enrolled in an MA plan, the client will need to switch from MA to MS during the Annual Enrollment Period (AEP), which is from October 15-December 7, once during the Open Enrollment Period (OEP), which is from January 1-March 31, or if they have a special circumstance that would allow them to switch during a Special Enrollment Period (SEP,) often due to a significant change in income, a move to a different area, or a FEMA-related emergency. It is important for clients to move from an MA plan to an MS plan when they can also pick up a Prescription Drug Plan.

Medicare Supplement Insurance, or Medigap Insurance policies, provide additional coverage for medical expenses Original Medicare does not cover. They provide help with copayments, coinsurance, and deductibles. Medical providers bill Medicare, who pays the Medicare-approved portion of the bill. Medicare then sends the excess bill amount to the Medicare Supplement carrier to pay its share, according to the plan’s terms.

Routine dental, vision, or hearing coverage is not offered through Medicare Supplements. Medically necessary treatments such as surgeries may be covered. Most Medicare Advantage Plans do cover routine dental, vision, and hearing. Some Ancillary Plans are also specially designed for dental, vision, and hearing, and they should be offered to your clients to ensure they are properly covered for these expenses.

No, they do not. A separate Prescription Drug Plan (PDP) must be offered to the client because Original Medicare also does not cover these expenses.

A separate Prescription Drug Plan (PDP) must be offered to the client unless the client has creditable prescription drug coverage elsewhere or has selected a Medicare Advantage plan.

Medicare Advantage Plans are an “all in one” alternative to Original Medicare that bundles Part A, Part B, and usually Part D. Unlike Medicare Advantage plans, Medicare Supplements sometimes have higher premiums, but the coverage is more extensive, and they do not have network restrictions.

No. Clients must decide which of the two types of coverage is better for them.

Yes. Clients may switch from a Medicare Advantage plan to a Medicare Supplement plan anytime during the Annual Enrollment Period (AEP), from October 15-December 7. They may also switch once during the Open Enrollment Period (OEP), from January 1-March 31.

Some circumstances will allow them to switch during a Special Enrollment Period (SEP). These periods can be initiated due to a significant change in income, a move to a different area, or a FEMA-related emergency.

It is important for clients to move from an MA Plan to an MS Plan when they can also pick up a Prescription Drug Plan.

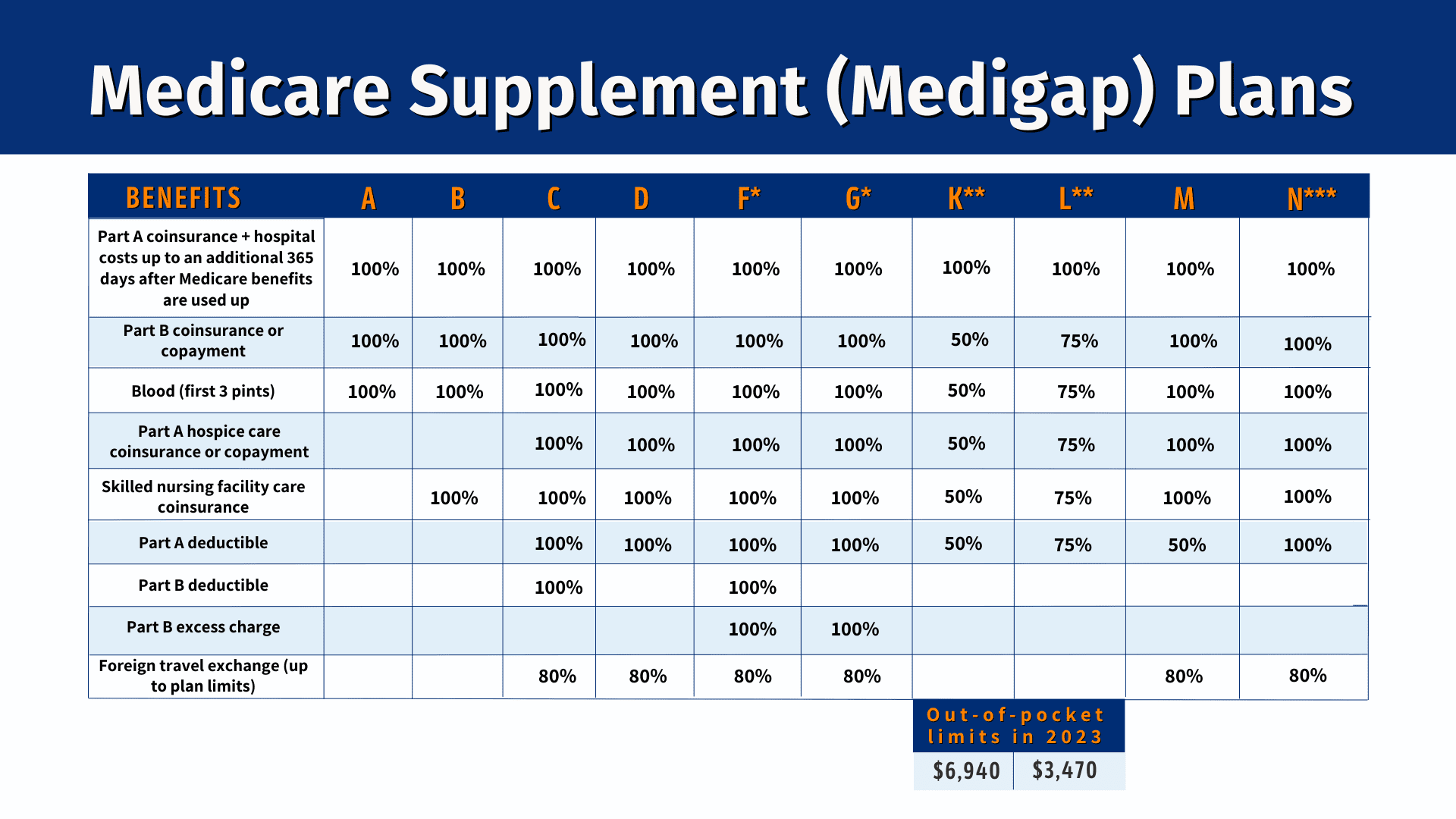

Medicare Supplement Plans do not follow the same restrictions as Medicare Advantage Plans; therefore, they do not require a Scope of Appointment to discuss or sell. Medigap policies are standardized, and in most states are named by letters, Plans A-N. Each standardized Medigap policy under the same plan letter must offer the same basic benefits, no matter which insurance company sells it.

To avoid underwriting, clients should enroll in a Medicare Supplement Plan during their Initial Enrollment Period (IEP,) which falls 3 months prior to their 65th birthday through 3 months after their 65th birthday. Alternately, clients may avoid underwriting if they provide evidence of their eligibility for guaranteed issue rights.

If the client is under 65 and has Medicare because of a disability or ESRD, they might not be able to buy a Medigap policy until they turn 65. Federal law does not require insurance companies to sell Medigap policies to people under 65. However, some states do require Medigap insurance companies to make Medigap policies available. Each state has a State Insurance Department that can provide detailed state guidelines on this topic.

Clients can apply for Medicare Supplements during their Initial Enrollment Period or after if they can go through underwriting. They may also apply if they are under 65 and have a disability or ESRD and are not currently enrolled in a Medicare Advantage program. If they are enrolled in an MA Plan, the client will need to switch from MA to MS during the Annual Enrollment Period (AEP), which is from October 15-December 7.

They may also switch once during the Open Enrollment Period (OEP), which is from January 1-March 31, or if they have a special circumstance that would allow them to switch during a Special Enrollment Period (SEP). These usually occur due to a significant change in income, a move to a different area, or a FEMA-related emergency.

It is important for clients to move from an MA Plan to an MS Plan when they can also pick up a Prescription Drug Plan.

To avoid underwriting, clients should enroll in a Medicare Supplement Plan during their Initial Enrollment Period (IEP,) which falls 3 months prior to their 65th birthday through 3 months after their 65th birthday. Alternately, clients may avoid underwriting if they provide evidence of their eligibility for guaranteed issue rights. If they are not concerned about passing underwriting, clients can apply for Medicare Supplements at any time if they are not currently enrolled in a Medicare Advantage program.

Suppose clients are currently enrolled in a Medicare Advantage program. In that case, they may switch from a Medicare Advantage Plan to a Medicare Supplement once during the Open Enrollment Period (OEP), which is from January 1-March 31.

Some Medigap policies (Plans C, D, F, G, M, and N) will cover emergency foreign travel expenses. Out-of-state medical expenses are also covered. In most cases, Medicare Supplements do not need to be adjusted even if the client moves to a different state because there are no network or provider restrictions with Medicare Supplements.

After switching from a previous one, clients have 30 days to decide if they want to keep a new Medigap policy.

Commissions may vary by state. However, the average street level commission on a new Medicare Supplement policy is 21-22% of the premium. Commissions for guaranteed issue policies are normally a lower, one-time commission.

We can help! If you are currently licensed to sell life and health insurance, the next step is to help you get contracted to sell Medicare Supplement policies with carriers in your area. One of our marketing specialists will be happy to connect with you to customize your sales and marketing plan.

Medicare Supplements can be sold the same way any other insurance policies are sold, and during these unprecedented times, most sales are made remotely over the phone. Most Medicare Supplement carries have user-friendly online platforms for you to enroll your clients over the phone while you are talking with them. They are more easily sold via phone than Medicare Advantage.

For anyone turning 65 Plan G is the most popular, followed by Plan N. Please refer to the chart below for more information on each plan’s specifics.

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) caused Plan F to no longer be available to anyone aging into Medicare after 1/1/2020. Plan G has many of the same features as Plan F, but clients will have to pay the Part B deductible in addition to the deductible for their Medicare Supplement.

If the client turned 65 prior to 1/1/2020, Plan F is still available and is the most popular Medicare Supplement for that group. It offers the most comprehensive coverage for clients, limits out-of-pocket costs, and allows clients to pay only the Plan F premium, not the Part B premium and Plan F premium.

SilverSneakers is a completely free-to-use fitness program for Medicare beneficiaries. Seniors across the nation with a SilverSneakers membership have unlimited access to over 14,000 gym locations. Insurance plans that offer SilverSneakers include Aetna, Humana, WellCare, and UnitedHealthcare.

Medicare Supplements are guaranteed to be renewed except in rare cases.

However, if a client is unable to pay his MS premium, he will be at risk of losing his coverage within 90 days of the unpaid premium date. The client may speak with Medicare to explain their loss of income, for example, and may qualify for a Special Election Period to switch to a Medicare Advantage Plan. Some MA Plans have low to no monthly premiums but will have higher out-of-pocket costs if the client develops a serious medical issue.

Don't See Your Question? Ask here!

Send us your question and we will answer it as soon as possible.

This request form will not work in Safari. Please use an alternate browser such as Chrome, Firefox, or Edge.