Did you know that, on average, losing and replacing an employee will cost you 33% of that employee’s annual salary? If your Medicare agency needs a reason to focus on agent retention, that one’s pretty compelling.

Find out how to retain not just any employees but the types of driven sales agents your Medicare agency needs to thrive.

#1: Recruit the Right Agents

You only get the best results when you start with the best materials. Give your agency a competitive edge by offering attractive benefits, and be sure to provide flexibility when possible. A 2019 study found that 80% of employees would feel increased loyalty toward employers if their workplace conditions were more flexible.

Now consider the type of person who does well in an industry like Medicare sales. They’re naturally independent and self-motivated. Flexibility is likely even more important to the employees you most want to recruit for your agency.

Offer as much flexibility as you can and emphasize that in your hiring to attract the most in-demand employees.

#2: Recognize Employee Performance to Increase Agent Retention

In 2019, a survey of over 1,500 employees found some compelling reasons to emphasize employee recognition. Among their findings:

- 63% of employees are not likely to look for new employment if they feel recognized by their current employer.

- 82% are happier at work in general if they feel their work is recognized.

- If you feel you already have recognition in the bag, don’t be so sure. 89% of company leaders surveyed believed their employee recognition was adequate. Only 62% of employees agreed.

Here, too, consider the personality types that will be most beneficial to your agency. They know what they deserve and expect it from an employer.

#3: Provide the Best Medicare Sales Training Possible

Your agents’ success is your success, so proper Medicare training is a no-brainer. This doesn’t mean just making sure they understand the ins and outs of Medicare and compliance. For training to have a real impact on agent retention, it needs to give your employees the confidence to do their jobs well.

Product knowledge is huge here. Train agents on the ins and outs of every product they’re selling. Ensure they understand what types of clients will benefit from which policies and can speak to beneficiaries with confidence.

You should also provide in-depth training in sales techniques. Ideally, you want to give your agents all the knowledge they need to initiate a conversation, close a sale, turn that client into a referral, and generate their next leads.

#4: Proper Tools are Critical to Medicare Agent Retention

In today’s landscape, providing your agents with the right tools and technology isn’t just helpful; it’s necessary.

Invest in a good CRM to help agents manage their client relationships, and make sure that CRM supports the flexibility today’s workforce demands. This article lists a few CRMs with mobile apps and may help you start your research. You’ll also find additional app recommendations to make your agents’ lives easier.

Additionally, help your agents sell more effectively by providing an enrollment platform that simplifies the process for clients. Remote enrollment options like text-to-enroll make the signing up easy for beneficiaries, allowing your agents to give clients the best experience possible.

#5: Make Your Agents Feel Supported

If you’re still using a sink or swim mentality, it might be time to update your management style. Today’s employees want to feel supported in their efforts. Your agents need to know that you have their back.

One straightforward way to support agents is through leads. Whether that means directly assisting agents with leads or helping them generate their own, make sure your employees always have more prospects on the horizon.

For an industry like Medicare sales, you might also look into setting up a mentorship program. Pair your newer agents with agency veterans so that even your most recent hires always know where to find advice or a listening ear.

#6: Offer Competitive Compensation

Your average sales agent is driven and goal-oriented, and the goal is earning money. In the case of Medicare agents, you’ll find they can forego a lot of other perks if you’re helping them earn more.

In the Medicare industry, you’re also bound by rules related to Fair Market Value (FMV). Outside of the industry, FMV essentially means the price a seller and buyer agree to when neither is being compelled. In Medicare, it’s a bit more complicated than that. As an agency, your compensation structure is subject to specific statutes intended to prevent fraud and abuse.

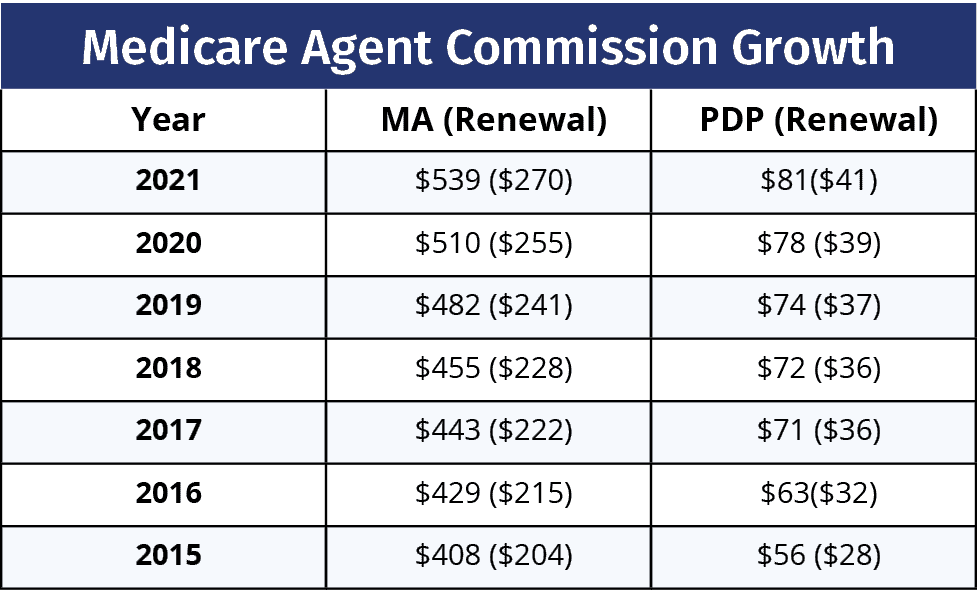

If you’re up for reading extensive legal documents, you can find a full description of how CMS defines Fair Market Value – as well as the changes made to that definition in December 2020 – at this link. What you need to know as an agency, however, is that you are held to a maximum commission for MA and PDP sales. CMS determines that max commission and releases updated numbers annually.

The chart below shows the annual maximum compensation for 2021, as well as in previous years.

While this does restrict your agent compensation somewhat, you can make up for the restriction in other ways.

If, for example, you have a Medicare General Agency contract (obtained by meeting certain carrier-specific requirements), you’re eligible for higher commissions. This is called an “override,” and you can pass those commissions on to your licensed sub-agents.

You can also compensate agents with incentives in the form of marketing assistance. At NCC, we offer a Marketing Assistance Program in which agents can earn flexible marketing dollars to use for lead mailers, advertising, seminars, or other marketing costs. This type of incentive program works well at the agency level and will help support your agent retention efforts.

Want to talk about finding and keeping the best agents for your agency? Give us a call at 800-695-0280.